Choosing between a new construction home and a resale property marks a major step in your home-buying journey. It’s one of the most significant financial decisions you’ll ever make, and while both paths lead to the pride of homeownership, the final closing phase unfolds very differently. Understanding these distinctions is crucial for managing your timelines, finances, and, most importantly, your expectations with confidence.

In this comprehensive guide, we break down every element of the closing process. We’ll go beyond the basics to explore the nuances of inspections, financing, paperwork, and the key professionals who guide you along the way. Tailored specifically for Indiana homebuyers seeking a clear and stress-free experience, this article will help you determine which option aligns best with your lifestyle, budget, and long-term goals.

What Is the Closing Process?

The closing process, also known as “settlement,” is the final, formal stage of the real estate transaction. This is where all legal, financial, and administrative tasks are meticulously completed, and the ownership of the property is officially transferred from the seller (or builder) to you. It’s the culmination of weeks or months of planning. Key steps in this phase include:

- Finalizing Your Mortgage: This involves a final underwriting review where the lender verifies your financial standing one last time. You’ll also lock in your interest rate (if you haven’t already) and receive the official “clear to close.”

- Completing Inspections and Appraisals: The property appraisal confirms the home’s value for the lender, while final inspections ensure all conditions of the contract have been met.

- Resolving Title Issues: A title company conducts a thorough search of the property’s history to uncover any potential claims, liens, or encumbrances. This ensures the seller or builder has the legal right to sell the property.

- Reviewing the Closing Disclosure: At least three business days before closing, you will receive a Closing Disclosure (CD) document. This critical form itemizes all final costs, including loan fees, closing costs, and the total amount you need to bring to the closing table.

- Signing the Legal Documents: At the closing meeting, you will sign a significant amount of paperwork, including the mortgage note (your promise to repay the loan) and the deed, which transfers ownership.

- Paying Closing Costs: You will pay for all closing costs and the remainder of your down payment, typically via a cashier’s check or wire transfer.

- Receiving the Keys: Once all documents are signed and the funds are transferred, you officially become the homeowner. Congratulations!

While these steps are universal, their execution, timing, and complexity differ significantly between new construction and resale homes.

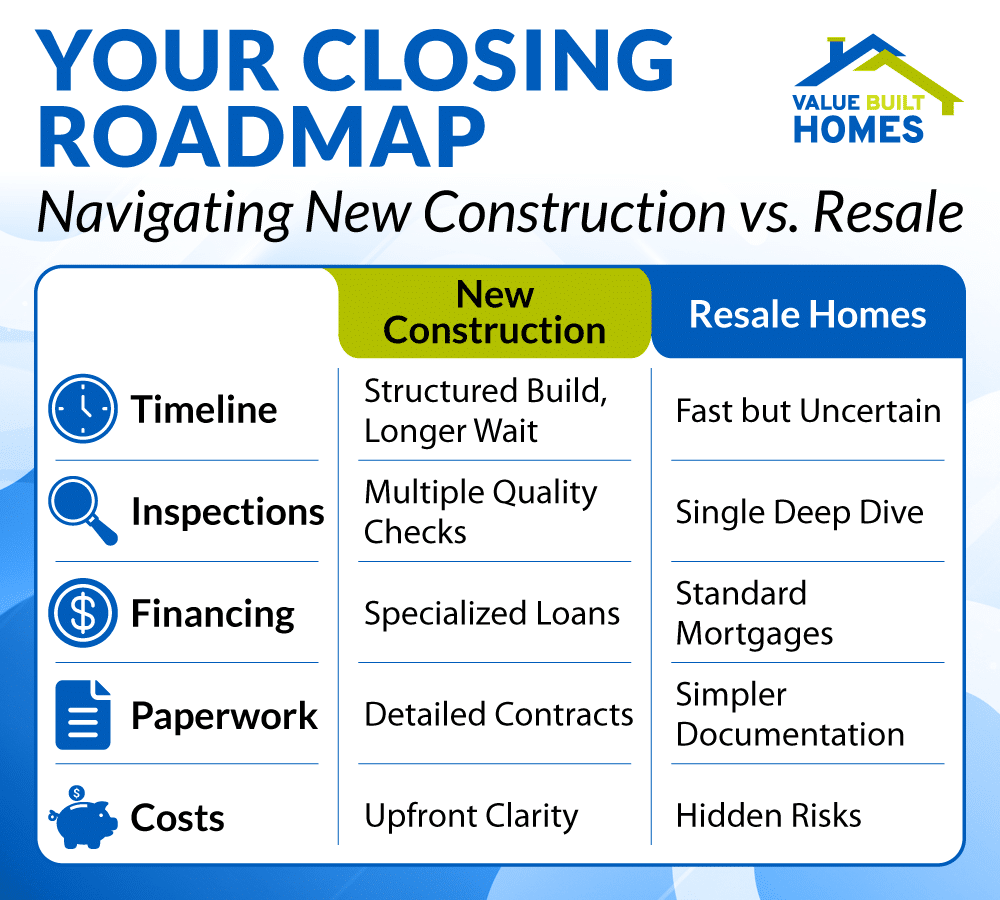

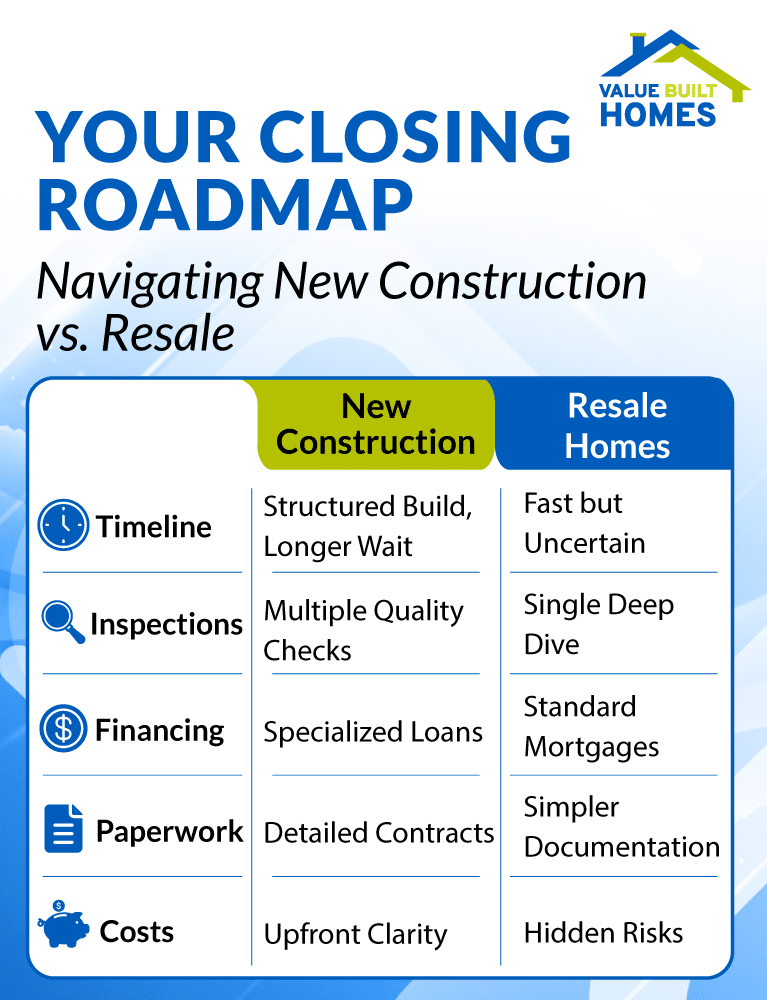

New vs. Resale: A Direct Comparison of the Closing Journey

To make the best decision, it’s helpful to compare the closing journey for both types of homes side-by-side. The experience, from the timeline to the final costs, can be vastly different.

Timelines: Predictable Milestones vs. Quick Turnarounds

- New Construction: The timeline is defined by a two-phase structure: a longer building phase with clear, predictable milestones, followed by the final closing. While the entire process is longer (often several months), this structured schedule minimizes surprises. Builders provide regular updates, so you know exactly when each stage – from pouring the foundation to framing and pre-drywall inspections – is complete. However, potential delays can occur due to weather, supply chain issues for materials, or permit approvals. A good builder will communicate these proactively.

- Resale Homes: The closing process is much faster, typically taking just 30 to 45 days after your offer is accepted. The home is already built, so the timeline is condensed into mortgage approval, appraisal, and inspection. However, this speed comes with uncertainty. The process can be abruptly delayed by a low appraisal, major issues discovered during the inspection, or the seller’s inability to find a new home.

Inspections and Property Condition

- New Construction: Quality is checked and verified at every step. New homes undergo multiple inspections at critical stages, such as the foundation, framing, and pre-drywall phases. This process ensures that plumbing, electrical, and structural components are correctly installed before they are covered up. This culminates in a final walkthrough (or “blue tape” walkthrough) where you and the builder identify and mark any cosmetic issues to be fixed before closing.

- Resale Homes: The inspection is a single, critical event focused on uncovering existing defects. A licensed home inspector will examine the property from top to bottom, looking at the roof, foundation, plumbing, electrical, and HVAC systems. In Indiana, common issues in older homes include foundation problems due to soil composition, outdated electrical systems, or moisture in basements. If significant problems arise, it can lead to stressful renegotiations for repairs or credits.

Financing and Payment Processes

- New Construction: Financing a new build often involves a specialized construction loan. Some arrangements, known as “two-time close” loans, involve one loan for construction and a second, separate mortgage once the home is complete. However, many builders, including Value Built Homes, work with trusted lenders who offer a streamlined “one-time close” or “construction-to-permanent” loan. This combines both phases into a single loan with one closing, saving you time and money.

- Resale Homes: The financing is more straightforward. You secure a traditional mortgage, such as a conventional loan or a government-backed option like an FHA loan or a VA loan. The process is standardized: apply, submit documents, get approved, and the funds are disbursed at closing.

Paperwork and Administrative Differences

- New Construction: The paperwork is more extensive because it must cover the entire building process. Your contract will include detailed specifications, material lists, floor plans, a timeline for construction milestones, and the comprehensive builder’s warranty. If you are in a new development, you’ll also receive detailed documentation and covenants for the homeowners association (HOA).

- Resale Homes: Documentation is simpler. It primarily consists of the purchase agreement, seller’s disclosures about the home’s known history and condition, and the lender-required forms.

Cost Considerations: Hidden and Upfront Expenses

- New Construction: Reputable builders provide detailed, upfront estimates. This transparency is a major benefit. However, the final price can increase with change orders or high-end upgrades. It’s also important to clarify which “finishing” items are included. Costs for landscaping, decks, fences, and even window treatments may not be part of the base price.

- Resale Homes: While the initial purchase price might seem lower, resale properties often carry the risk of significant hidden costs. An older home may soon need a new roof ($10,000+), an HVAC replacement ($5,000+), or a new water heater ($1,500+). These are major expenses that can surface unexpectedly within the first few years of homeownership.

The Modern Homeownership Advantage

New construction offers unique benefits that go beyond the closing table, focusing on modern efficiency, health, and simplified logistics.

Advancing Sustainability and Smart Home Integration

New homes are built to the latest energy codes. This includes advanced insulation, high-performance Low-E windows, and energy-efficient appliances. This not only reduces your carbon footprint but also leads to significantly lower monthly utility bills. Many new homes also come pre-wired for smart home technology, allowing you to easily integrate thermostats, security systems, and lighting. These features can qualify you for tax credits and incentives, as outlined by programs like ENERGY STAR.

Navigating Permits and Local Regulations

Building a new home requires securing numerous permits and complying with complex local building codes and zoning laws. An experienced builder handles this entire, often-frustrating process for you. This expert guidance is invaluable, as it prevents costly delays and ensures your home is built to the highest safety and quality standards.

Key Players and Safeguards in Your Journey

Throughout the closing process, several key professionals and protective measures are in place to ensure a smooth and secure transaction.

The Role of the Real Estate Agent

An agent is a valuable advocate, but their role differs:

- In New Construction: An agent experienced with new builds acts as your liaison with the builder. They understand the builder’s contract, help you navigate the selection process, and ensure your interests are represented at every milestone.

- In a Resale Transaction: Your agent is your primary negotiator. They help you craft a competitive offer, analyze the market, negotiate for repairs based on the inspection, and manage the back-and-forth with the seller’s agent.

The Importance of Title Insurance

Whether you’re buying new or resale, title insurance is a critical safeguard. A title search is conducted to ensure the property has a “clear title.” Title insurance is a one-time fee paid at closing that protects you from unforeseen title defects. There are two types: a Lender’s Policy, which is required and protects the lender, and an Owner’s Policy, which is highly recommended and protects your equity in the property. It guarantees your legal ownership, providing essential financial protection.

The Emotional Journey: Managing Expectations

The path to homeownership is not just financial; it’s also deeply emotional.

- New Construction: This journey requires patience and vision. You are watching your home be created from the ground up, which is incredibly exciting. However, seeing an unfinished house can be challenging; you have to trust the process and visualize the final product. The reward is a home that is perfectly, uniquely yours.

- Resale Homes: This journey is often a whirlwind of speed and compromise. The search can be exhilarating, but it can also be met with the disappointment of being outbid or discovering a home you love has major flaws. It requires emotional resilience and a willingness to compromise on your “perfect home” checklist.

Long-Term Value and Planning: Post-Closing Considerations

Once the keys are in your hand, your work isn’t quite done. Create a checklist for immediate, monthly, and annual home maintenance. For a new build, this includes understanding your warranty and the break-in period for a new home. For a resale, it means prioritizing any repairs or updates you want to make. Budgeting for property taxes, insurance, and an emergency repair fund is crucial for long-term financial health.

A Proactive Approach: Tips for a Smooth Closing

For New Construction:

- Ask Detailed Questions: During your walkthroughs, ask about the warranty, how to operate the systems in your home, and the builder’s process for post-closing service calls.

- Document Everything: Keep a binder with all of your contracts, change orders, and communication with the builder.

For Resale Homes:

- Attend the Inspection: Being present for the home inspection allows you to ask the inspector questions and see any potential issues firsthand.

- Get Repair Agreements in Writing: If the seller agrees to make repairs, ensure the details are documented in a formal addendum to the purchase agreement.

Is New Construction Right for You?

Your decision ultimately depends on your priorities.

Choose New Construction If You Value…

- Complete Customization: You want to choose the finishes, fixtures, and layout to create a home that perfectly reflects your style, with no need for immediate renovations.

- Energy Efficiency and Modern Tech: You prioritize lower utility bills, a smaller environmental footprint, and the convenience of a home built for modern living.

- Peace of Mind: You want the security of a comprehensive builder’s warranty and the knowledge that all components of your home are brand new.

Choose Resale Homes If You Prefer…

- A Quick Move-In: Your timeline is tight, and you need to be in a new home within a month or two.

- Established Neighborhoods: You value the charm of mature trees, established communities, and a specific location or school district.

- A Potentially Lower Initial Price: You are prepared to take on potential repairs and updates in exchange for a lower upfront purchase price.

Making Your Final Decision: New Construction vs. Resale

Understanding the distinct closing processes for new construction and resale homes empowers you to make a confident and well-informed decision. Resale homes offer speed and the charm of established surroundings but may come with the baggage of unexpected repair costs and the need for renovations. New construction provides a modern, efficient, and fully warrantied home built to your specifications, guided by a clear, step-by-step process.

By carefully weighing these differences in timelines, costs, and long-term benefits, you can choose the path that best fits your family’s needs and future.

Ready for a clear, stress-free closing experience and a home built just for you? Contact Value Built Homes today to take the next step toward unlocking your perfect home.