Building your dream home can be an exciting and transformative journey. However, when you’re juggling current housing expenses—such as rent or an existing mortgage—alongside the costs of new construction, having a flexible payment plan is crucial. Interest-only payments during the build can provide that flexibility by letting you pay only the interest on the funds drawn from your loan. This guide explains how these payments work, why they change over time, and offers actionable strategies to help you manage your cash flow effectively.

A clear understanding of interest-only payments will help you anticipate fluctuating monthly costs, plan for overlapping housing commitments, and avoid financial surprises. Whether you are a first-time homebuyer or planning your next home in Indiana, this guide provides budgeting tips to ensure a smoother construction experience.

What Are Interest-Only Payments During Home Construction?

Interest-only payments are a temporary arrangement for the construction phase. Rather than repaying interest plus principal from the start, you cover only the interest on the portion of the loan that’s already drawn. As the builder receives additional draws, your cumulative balance—and thus your monthly interest—goes up.

Because you’re charged interest only on the portion of the loan that has been drawn, your initial construction loan payments are typically lower. As construction progresses and larger sums are released for labor and materials, your payment will gradually increase. This structure can free up cash flow for other expenses, such as land preparation or temporary housing.

Why Is This Financing Approach Common in Home Construction?

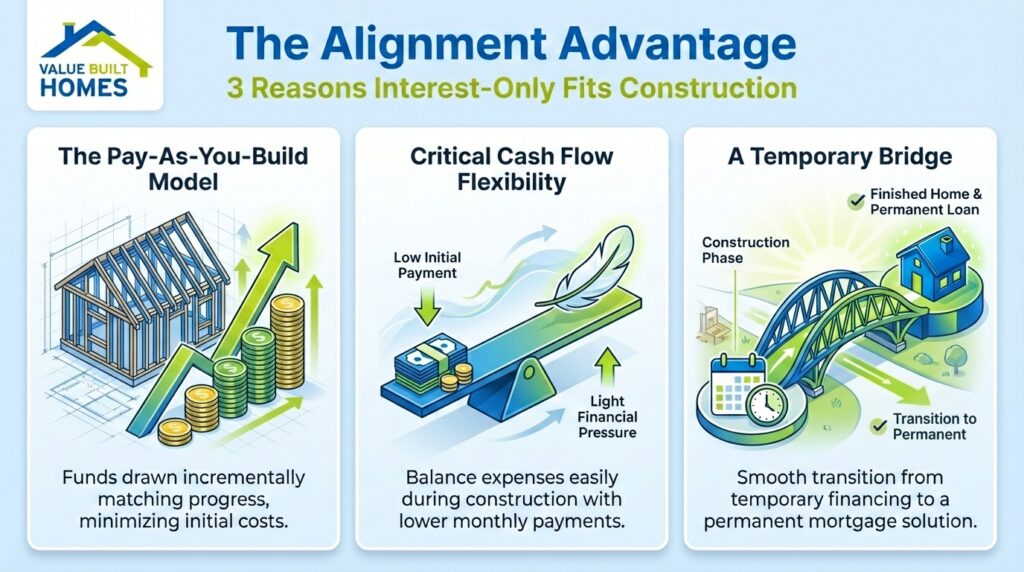

Interest-only payment structures are widely used for construction loans because they align with the dynamic nature of building a home. Here’s why they’re prevalent:

- Incremental Funding for Phased Construction: Since you don’t receive the entire loan upfront, you only pay interest on the amount that has been used.

- Improved Cash Flow Flexibility: Lower payments early in the build can help you manage other obligations, such as rent or mortgage payments on your current home.

- Short-Term Nature: Construction loans typically last 6 to 12 months, until the home is completed and refinanced into a long-term mortgage or paid in full.

Keep in mind that interest-only payments don’t necessarily mean you’ll pay less overall. Extended build times or rising interest rates can result in higher total costs. Meticulous planning is essential to manage the variables inherent in a site-built home project.

Why Your Payment Isn’t Fixed—How Draws Affect Monthly Changing Costs

A key feature of construction financing is that your monthly interest payment increases as your builder requests more funds. This variance corresponds directly to the loan’s draw schedule, which outlines when funds are released.

How Construction Draws Work

Funds get distributed in stages based on milestones. Each time a draw is approved, the total balance—or amount “on the books”—increases, and so does the next month’s interest payment. For example, if your first draw is $50,000, your initial interest payment stays relatively low. But when additional draws push your balance to $200,000 or more, the monthly interest obligation will naturally rise.

When Do Interest-Only Payments Begin and End?

Interest-only payments usually start as soon as the first draw is made and continue until the build is finished. This phase might last about 9 to 12 months, but could extend if there are setbacks or changes. When your home is complete, the loan typically converts to a permanent mortgage—expect a higher monthly payment at that point.

Payment Progression as Construction Advances

- Early Construction (Site Preparation and Initial Materials): Smaller loan draws result in modest monthly payments.

- Midway Through (Framing, Roofing, Major Installations): Payments increase as the construction draws become larger.

- Final Stages (Finishing Touches): Once the bulk of the loan is drawn, monthly interest payments approach the full intended amount.

Each funded amount raises the balance on which interest is calculated, so payments fluctuate upward accordingly.

Estimating Your Construction-Phase Payments: Simple Formula & Strategies

Estimating your monthly interest in advance helps you avoid unpleasant surprises. A common formula is:

Monthly Interest Payment = (Drawn Balance × Annual Interest Rate) ÷ 12

If your drawn amount is $150,000 with an annual interest rate of 6%, your monthly payment for that period would be:

($150,000 × 0.06) ÷ 12 = $750

Keep in mind that some construction loans come with adjustable rates, which can affect future payments. Using an online calculator or speaking with your lender about rate adjustments will give you a clearer picture of what to expect.

Proactive Budgeting Strategies

- Watch your cash flow closely. Track construction progress and future draws to anticipate payment changes.

- Communicate frequently with your builder to avoid unexpected delays or cost overruns.

- Keep a buffer for potential interest rate hikes or other unforeseen expenditures.

- Limit last-minute upgrades that can significantly increase the loan draw amount—and your payments.

Budgeting Situations Every Buyer Should Know

By exploring real-life scenarios, you can more accurately plan your finances during construction.

Early Build: Low Draws, Minimal Payments

Initial draws tend to be smaller, aligning with preliminary tasks like obtaining permits or site work. Early-stage monthly payments remain lower, creating a window of flexibility for your budget.

Mid-Build: Payments Rise with Larger Draws

As the builder reaches pivotal construction stages (e.g., framing, roofing), more substantial draws raise your outstanding loan balance. Prepare for incremental jumps in your monthly interest payments.

Build Delays: Extended Interest-Only Period

Delays—ranging from weather issues to supply chain problems—can lengthen how long you stay in the interest-only phase. This may also increase certain fees, so maintain a cushion for extended timelines.

Double Housing Costs During Construction

Covering rent or an existing mortgage simultaneously with construction costs is common. During early draws, interest-only payments help reduce the total financial load until you can move into your new Indiana home.

After Completion: Transition to Principal-and-Interest Payments

Once your home is finished, interest-only payments convert to regular mortgage installments, which are higher. Knowing your permanent financing terms helps avoid sticker shock when your monthly obligations increase.

Hidden Budget Pressures: Expenses Beyond Interest-Only Payments

While interest-only payments are a helpful budgeting tool, be aware of other construction-phase expenses that can impact your bottom line.

Establishing a Contingency Fund

Set aside 5–10% of your total project budget in a contingency fund to manage unforeseen challenges like material price hikes or design changes. This buffer prevents smaller setbacks from snowballing into major financial burdens.

Additional Construction-Related Costs

Alongside your interest payments, plan ahead for:

- Insurance Premiums: Builder’s risk insurance can protect against unexpected damages.

- Utility Setup: Temporary water and electricity can add up.

- Permit Fees: Vary by location and often increase overall costs.

- Inspection Fees: Required safety checks may involve separate charges.

- Change Orders: Any modifications partway through the build can lead to price surges.

How Your Loan Structure Shapes the Construction Phase

Your payment process hinges on the type of loan you secure. Understanding whether you have a one-time close or a two-time close arrangement can help you plan for transitions between interest-only and permanent financing.

One-Time Close vs. Two-Time Close Construction Loans

- One-Time Close Loans: Combine construction and permanent financing in a single package, streamlining the process.

- Two-Time Close Loans: Require separate loans for construction and the finished home. This structure can offer flexibility if you anticipate any major changes during the build.

Transitioning to Full Repayment

Once your new home is complete, you’ll transition to a permanent mortgage that incorporates both principal and interest payments. To prepare:

- Budget for higher costs as your payment includes principal starting with your permanent mortgage.

- Factor in additional expenses such as closing costs, as detailed in common closing costs for new construction homes.

- Understand your loan terms; some construction loans convert automatically, while others require a separate refinancing process. For guidance, see Tips for Evaluating Mortgage Rates.

Construction-Phase Budgeting Checklist

A well-organized checklist keeps you on track. Below are crucial steps to build and maintain financial stability throughout your home construction.

Questions to Ask Your Lender

- How frequently can draws be requested, and at which milestones?

- Is the interest rate fixed or adjustable?

- When does the loan convert to principal-and-interest payments?

Questions for Your Builder

- Which specific milestones trigger new draws?

- Are there recommended ways to manage deposit-heavy purchases for materials?

- What’s the plan to handle unexpected delays?

Preparing Your Cash-Flow Buffer

- Reserve 5–10% of your total budget for overruns.

- Monitor your existing mortgage or rent obligations alongside construction payments.

- Keep open communication with both lender and builder for better transparency.

Before finalizing any schedule, reviewing a construction timeline can help you map out each stage.

Tips for Budgeting and Financial Preparation

Even with interest-only construction loan payments, a strong overall financial plan is paramount. Consider these steps:

- Develop a comprehensive budget covering design, materials, labor, and unexpected expenses.

- Establish a contingency fund to cover potential cost increases or unforeseen expenses.

- Track loan draws carefully and maintain frequent communication with your lender.

- Monitor interest rates and plan for the eventual principal payments once construction is complete.

- Stay in regular contact with your homebuilder to remain informed about project status and any cost variations.

How Value Built Homes Simplifies Your Construction Budget with Free Financing

If you’re building in Indiana and need a stress-free approach to financing, Value Built Homes stands apart with our free construction financing program. By covering interest payments during construction, we help alleviate the stress of paying for two homes at once.

Benefits of Free Construction Financing

- Zero Interest Payment Burden: We take care of the interest during construction so you can focus on other costs.

- Streamlined Process: Our efficient management system keeps unnecessary delays at bay.

- Enhanced Financial Clarity: Working with Value Built Homes ensures you have better visibility into every cost component.

FAQs About Interest-Only Payments During Construction

Do I pay interest on the entire loan amount upfront?

No. You pay interest only on the dispersed amount, so earlier payments remain lower due to smaller draws.

Why did my payment increase suddenly?

If a major draw was disbursed to your builder or if your interest rate is adjustable, your monthly payment can rise in response.

Can I lock in my interest rate?

Many lenders offer options to lock rates during construction. Discuss rate lock terms early to avoid surprises.

What happens after construction?

After your home is built, payments convert to principal-and-interest. Be prepared for a larger monthly expense at that stage.

What if there are construction delays?

Delays lengthen the interest-only period and may add fees. Stay proactive and communicate regularly with your lender and builder.

Take Control of Your Construction Financing Journey

Interest-only payments can make building a new home more manageable—especially when you understand one key reality: your payment changes as draws are taken. By tracking your draw schedule, estimating payments with a simple interest formula, planning for “hidden” construction costs, and keeping a contingency cushion, you can avoid surprises and stay confident throughout the build.

Ready to explore your options? Browse our floor plans and contact Value Built Homes to ask about free construction financing, your estimated timeline, and what your construction-phase budget could look like for your new home.