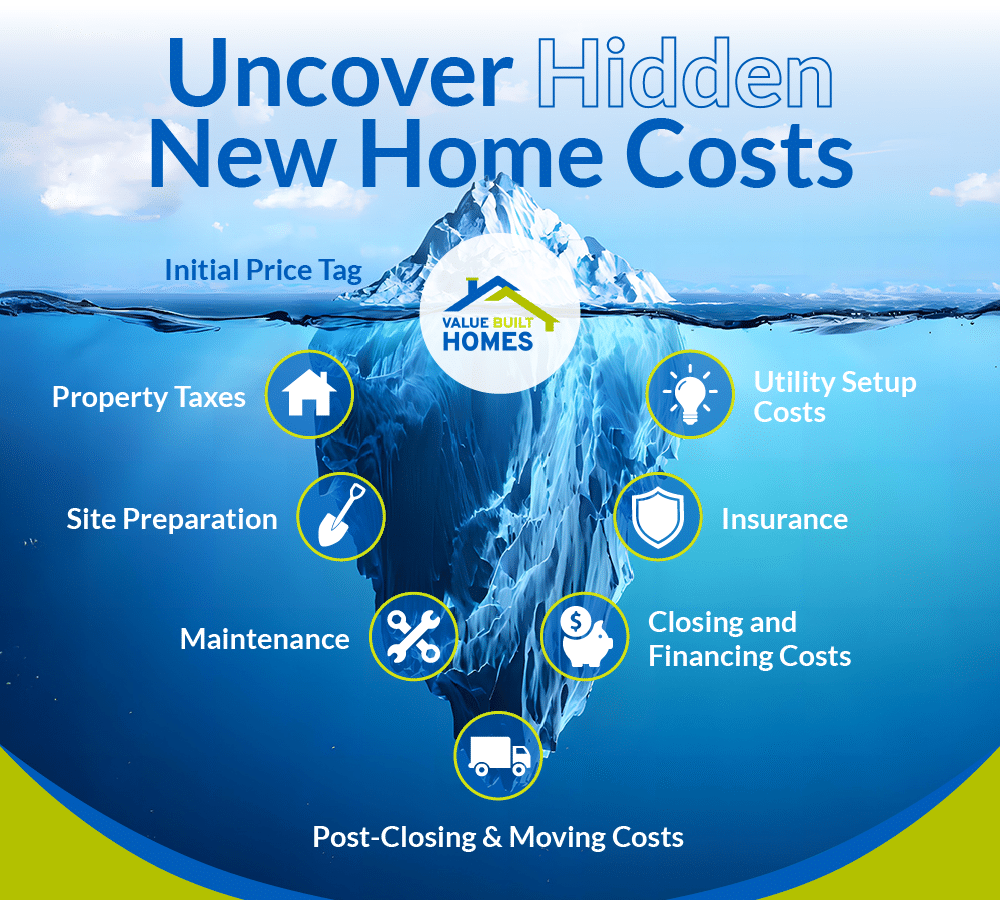

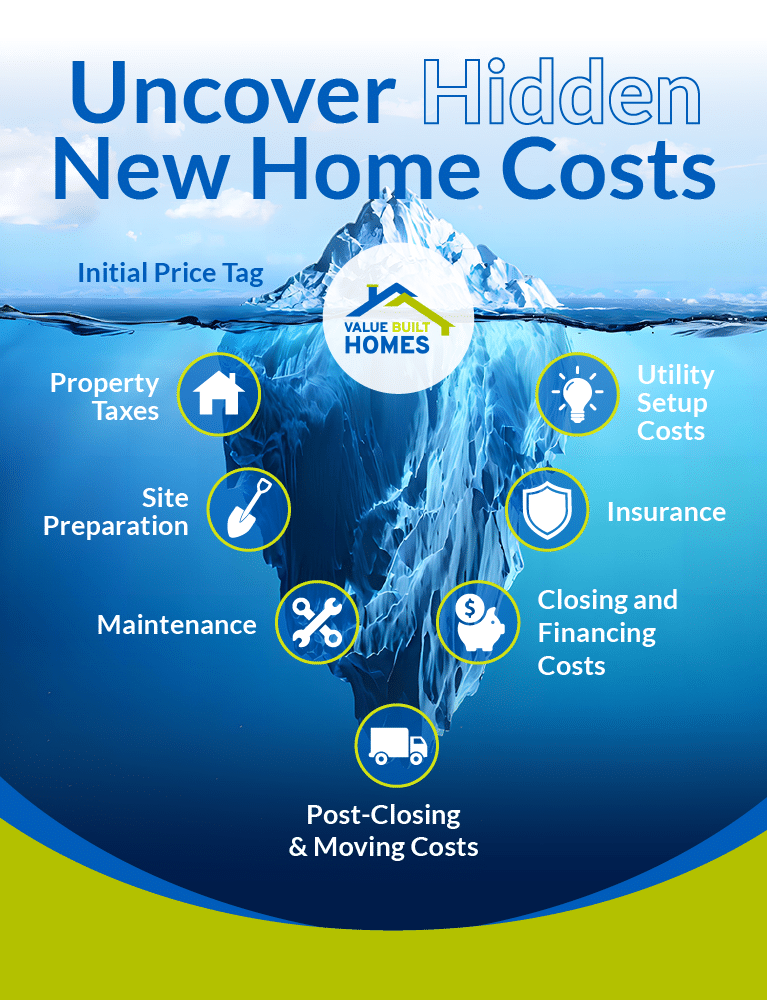

Buying a new home is an exciting milestone, but it’s also one of the most significant financial decisions you’ll ever make. While most homebuyers focus on the listing price or the features of their dream property, it’s easy to overlook the additional, often hidden costs that accompany the purchase. These expenses can disrupt even the most carefully planned budget, leaving new homeowners unprepared for the financial realities of owning a home.

In this guide, we’ll explore the most common hidden costs of buying a new home, provide practical tips for minimizing these expenses, and discuss how partners like Value Built Homes assist homebuyers in navigating these challenges. We encourage prospective buyers to request detailed, up-front pricing information to clarify all costs.

Why Homebuyers Often Overlook Hidden Costs

For many homebuyers, the financial focus tends to revolve around two main areas—finding a property within their budget and calculating mortgage payments. While these are pivotal aspects, the less obvious costs of owning or building a home are often overlooked. These hidden expenses can disrupt even the most meticulous financial planning, catching buyers off guard when they least expect it.

But why are these costs so frequently missed? Here are some of the common reasons:

- Underestimating Property Taxes: Buyers often don’t realize how much property taxes can vary depending on location, property size, and improvements made, such as building a new home on previously vacant land.

- Overlooking Utility Setup Costs: Connecting utilities like electricity, water, and internet—especially for newly built homes—comes with fees that aren’t always obvious upfront.

- Not Accounting for Site Preparation: Clearing and grading land or handling unexpected soil issues are expenses that can easily go unnoticed when budgeting for construction.

- Insurance and Maintenance Oversights: Buyers may fail to account for additional costs like specialized coverage for high-risk areas or ongoing expenses such as landscaping or HVAC servicing.

- Unawareness of Closing and Financing Costs: Lender fees, title insurance, and construction loan interest are just some of the final-stage expenses buyers might initially overlook.

Local regulations in Indiana can also be a factor, so exploring resources from local builders and associations can be very helpful. By being proactive and factoring in these extra costs, you’ll be more prepared for the true price of homeownership.

Common Hidden Costs When Buying a New Home

Understanding the hidden costs of buying or building a new home is key to avoiding financial surprises and keeping your budget on track. Below are some of the most common overlooked expenses that can catch homebuyers off guard.

Property Taxes

Property taxes are ongoing expenses calculated based on your home’s assessed value, which combines the value of the land and the structure. In many areas, these taxes can vary widely depending on the location and local tax rates. For instance, areas with stronger school systems or more developed infrastructure may have higher rates. Additionally, building a new home on vacant land may result in a higher assessed value, leading to increased taxes over time.

When budgeting for property taxes, consider:

- Location-specific rates, which can differ by county or municipality.

- Home size and value, which directly affect assessed value.

- Possible reassessments following construction or major improvements.

Utility Setup Costs

Setting up utilities in a new home is often overlooked, yet these initial fees can be substantial—especially for newly constructed homes or homes on previously undeveloped land. These costs extend beyond regular monthly bills to include permitting and installation.

Key considerations include:

- Extensions of power or gas lines when infrastructure is limited.

- Permits and connection fees for municipal water or sewer systems, or costs for private wells and septic systems.

- Telecommunications setup, such as broadband internet or cable, may require additional installations in more remote areas.

Planning for these one-time charges can help you maintain a realistic budget before moving in.

Site Preparation Costs

Preparing your land for construction is another area where costs can escalate, often creating financial stress for unprepared buyers. Even seemingly build-ready lots can require specialized work.

Common expenses include:

- Land clearing for debris, trees, or brush.

- Grading and drainage improvements to ensure a stable foundation.

- Soil amendments or special foundations in regions with unstable terrain.

- Additional water management measures if the lot experiences poor drainage.

Home Insurance and Specialized Coverage

Buying the right insurance policy for your home is essential, but the total cost can vary widely depending on the location, risks, and the type of coverage required. Many buyers may overlook supplemental policies needed for certain climates or conditions.

Key factors:

- Flood insurance in high-risk flood zones.

- Wind or hail riders in areas prone to severe weather.

- Comprehensive replacement coverage which may cost more but can be vital for full protection.

Maintenance and Long-Term Ownership Costs

New homes often feature fewer initial repairs, but maintenance still plays a major role in long-term affordability. Proper upkeep ensures that your home remains both comfortable and retains its value should you decide to sell later on.

Budget for:

- Landscaping: Initial establishment plus ongoing care.

- HVAC Maintenance: Regular inspections and filter replacements.

- Pest Control: Preventative measures to avert infestations.

- Appliance Care: Routine maintenance of new appliances to avoid unexpected failures.

Planning a monthly or yearly reserve for these items can help absorb any unforeseen costs over time.

Financing and Closing Costs

Home loan expenses extend well beyond your interest rate and down payment. Financing and closing costs, including lender fees, appraisal charges, and various associated funds for taxes and insurance escrows, can add thousands of dollars to your final cost—even if robust planning helps keep surprises to a minimum.

Possible expenses include:

- Lender fees (application, origination, underwriting).

- Appraisal and survey costs for property verification.

- Escrows for taxes and insurance, which might be required upfront.

- Construction loans, which often have higher rates and additional fees before the home is complete.

Post-Construction & Move-In Costs

The financial journey of building a new home doesn’t end when you sign the closing documents and receive the keys. Post-closing and moving costs, encompassing everything from the physical relocation itself to the immediate necessities of setting up your new residence, can quickly accumulate. These expenses, often considered afterthoughts in the excitement of homeownership, can strain your budget if not proactively considered alongside the construction costs.

Possible expenses include:

- Moving services (professional movers, truck rentals, packing supplies).

- New furniture and essential household items to furnish the new space.

- Appliances like refrigerators, washers, and dryers that may not be included in the builder’s package.

- Window treatments (blinds, curtains, shades) for privacy and light control throughout the home.

How Value Built Homes Helps Minimize Hidden Costs

Building your dream home should be an exciting and well-planned process. Value Built Homes focuses on simplicity, affordability, and energy efficiency—helping you anticipate and manage many of the hidden expenses that can occur along the way.

Thoughtfully Designed, Ready-Made Floor Plans

Pre-designed floor plans are offered as a way to help lower the risk of unforeseen costs while delivering quality and modern design. These plans are engineered to reduce the occurrence of unexpected expenses; however, while they significantly mitigate risk, they do not completely eliminate the possibility of unforeseen issues during construction.

Faster Construction Times Reduce Stress and Costs

Construction delays can lead to unexpected expenses—from increased loan interest to additional housing costs while waiting for your move-in date. By adhering to a structured building schedule, Value Built Homes works to finish projects efficiently, though occasionally unforeseen circumstances can extend timelines. This organized process can help reduce overlapping costs, although absolute prevention of delays is not guaranteed.

Transparent and Upfront Pricing

Value Built Homes prioritizes clear communication about costs from the outset. They work to provide transparent pricing models, especially for their ready-to-build lot and home packages in desirable Southern Indiana neighborhoods. This upfront approach helps you understand your financial commitment early on, minimizing unexpected budget surprises down the line.

Energy-Efficient Features for Long-Term Savings

Energy efficiency is a significant focus. High-performance insulation, contemporary HVAC systems, and efficient windows all contribute to reduced monthly utility bills and a smaller environmental footprint. Over time, these features help lower the total cost of homeownership while supporting a modern design ethos.

Ready to Build Lots

Value Built Homes enhances transparency from the very foundation of your project by offering ready-to-build lots in desirable neighborhoods. Recognizing that land acquisition can be a source of hidden costs and unforeseen complications, Value Built Homes streamlines this crucial initial step. They offer lots within sought-after communities, ensuring they are suitable for building and often positioned within established or developing neighborhoods with desirable amenities. Crucially, Value Built Homes is committed to transparent pricing for these lot and home packages. This means providing clear, upfront costs for the land component, minimizing the potential for unexpected expenses related to site work or unclear land values.

Local Expertise and Regulatory Guidance

Value Built Homes brings a level of practical knowledge regarding local building practices and requirements. They strive to guide clients through various regulatory processes. While they are familiar with local codes and standards, homeowners should conduct their own research into current requirements to ensure complete regulatory compliance.

Tips for Identifying and Managing Hidden Costs

Whether you’re building a home from scratch or purchasing a newly constructed property, proactive planning is the key to managing costs and keeping your finances on track.

Work with Knowledgeable Professionals

Collaborate with experienced builders, inspectors, and financial advisors who can help you identify potential challenges early and provide realistic cost estimates. Consulting certified local experts or reputable industry organizations can prove especially valuable.

Create a Detailed and Itemized Budget

Don’t just rely on a general estimate. Break down every aspect of the project, from land acquisition and site preparation to interior finishes and landscaping. Research average costs in your area for each line item to create a realistic baseline. Include allowances for items like fixtures and flooring, but be specific about the range of those allowances and what happens if you exceed them.

Ask Detailed Questions and Get It in Writing

Don’t hesitate to ask your builder, contractors, and lenders for comprehensive, itemized quotes. Specifically inquire about what is included and excluded in their pricing. Clarify allowances, upgrade costs, and the process for handling change orders. Crucially, get all agreements, quotes, and clarifications in writing to avoid misunderstandings later.

Research Local Permits, Fees, and Regulations

Investigate building permit fees, impact fees, utility connection charges, and any other local regulatory costs specific to your location before finalizing your budget. Contact your local municipality or permitting office directly to get accurate figures.

Scrutinize Contracts Carefully

Before signing any agreements, thoroughly review all contracts with a critical eye. Pay close attention to clauses related to allowances, change orders, payment schedules, warranties, and dispute resolution. Consider having a real estate attorney review complex contracts, especially for custom builds.

Build a Robust Contingency Fund

Expect the unexpected. Set aside a dedicated contingency fund, ideally 10-20% of your total project budget, to absorb unforeseen costs, delays, or necessary upgrades. Treat this fund as non-negotiable and avoid dipping into it for non-essential upgrades early in the process,

Conduct Thorough Site Evaluations (or Review Existing Reports)

If building on raw land, invest in professional site evaluations for soil conditions, topography, utility access, and environmental factors. If buying in a development, ask for and review any existing site assessment reports. Understanding site specifics upfront can prevent costly surprises during construction.

Stay Engaged and Monitor Progress Regularly

Maintain open communication with your builder throughout the process. Visit the construction site regularly (safely and at appropriate times) to monitor progress and ask questions. Track expenses against your budget to identify any deviations early and address them proactively.

Prioritize Needs vs. Wants (Especially Initially)

Be realistic about your budget. Focus on essential features and structural elements first. Consider deferring cosmetic upgrades or non-essential features until after you move in, if budget constraints arise. Remember, you can always upgrade later.

Plan Smart, Build Smart: Say Goodbye to Hidden Homebuilding Costs

Hidden costs can transform the thrill of buying or building a home into an unexpected financial challenge. By thoroughly researching expenses such as property taxes, utility fees, site preparation, insurance, and maintenance costs—and by taking proactive measures to plan for unexpected issues—you can preserve both your budget and peace of mind.

At Value Built Homes, the mission is to simplify your journey to homeownership with a streamlined building process, modern design options, and a commitment to energy efficiency. We recommend engaging directly with builders to obtain detailed breakdowns of costs and to discuss any concerns about transparency and regulatory compliance.

If you’re ready to explore a more predictable, stress-mitigated homebuilding experience, consider contacting Value Built Homes to learn more about their process, floor plans, and available support. Take the next step toward building your dream home—while keeping surprises to a minimum. Let’s build your future together!