Bringing your dream home to life is an exciting journey filled with countless possibilities. Yet, navigating construction can be overwhelming, especially financing. For many future homeowners, questions often arise about how to manage the complexities of financing a new home build. That’s where construction loans come into play.

A construction loan is a specialized financing option designed to support your home-building journey. They cover everything from purchasing the perfect plot of land to overseeing the construction financing process itself. By understanding construction loans and how they work, you can secure the foundation for realizing your dream while staying financially prepared.

At Value Built Homes, we aim to simplify the home-building journey by collaborating with experienced lenders and providing transparent pricing. While we do not directly offer construction loans, our streamlined building approach integrates construction financing seamlessly into your home-building experience. Whether it’s the simplicity of our pre-designed floor plans or the efficiency of our build times, we work closely with you and our lending partners to ensure the financing process is as smooth as the construction itself.

In this guide, we’ll walk you through the essentials of construction loans, outline their benefits, and show how they align with our philosophy at Value Built Homes. Together, let’s make building your dream home an achievable reality.

What Are Construction Loans and How Do They Work?

Construction loans are a specialized financing solution designed specifically for building new homes. Unlike traditional mortgages which are meant for purchasing pre-built homes, construction loans break the financing process into manageable stages. These loans provide funding in stages, aligning with each phase of construction—from laying the foundation to the final touches. Here’s how the process works:

Key Differences Between Construction Loans and Traditional Mortgages

Understanding the distinctions between these two types of loans is essential:

- Purpose: Traditional mortgages finance existing homes, while construction loans fund building a house from start to finish, including land acquisition if necessary.

- Loan Structure: These are short-term loans often lasting 12 to 18 months, with slightly higher interest rates due to the added construction risks.

- Disbursement Method: Unlike mortgages that disburse funds as a lump sum, construction loans are distributed in stages, releasing funds as specific construction milestones are achieved.

What Do Construction Loans Cover?

These loans are comprehensive and can address various costs related to building your home, including:

- Land Purchase: Financing the purchase of your chosen plot of land.

- Building Expenses: Covering materials, labor costs, and specialized services.

- Builder Payments: Funding payments to contractors and subcontractors at different stages of the project.

- Permits and Fees: Covering necessary expenses such as building permits and inspections.

How the Disbursement Process Works (The Draw Schedule)

Construction loan funds are released in stages as your project progresses. Payments, or draws, are released incrementally at predefined milestones—for example, after completing the foundation or framing. An inspector typically reviews the work at each stage to verify progress, ensuring funds are only released for completed work. This structured approach helps maintain the project’s budget and schedule.

Transitioning from a Construction Loan to a Permanent Mortgage

One common type of construction financing is a construction-to-permanent loan. This option makes the financing experience seamless by transforming the short-term construction loan into a permanent mortgage once the home is completed. With this setup, you avoid the inconvenience and expense of multiple closings. Lenders often allow borrowers to lock in their mortgage rate during the construction phase, offering peace of mind that your rate won’t increase.

Exploring Types of Construction Loans for Your Home Build

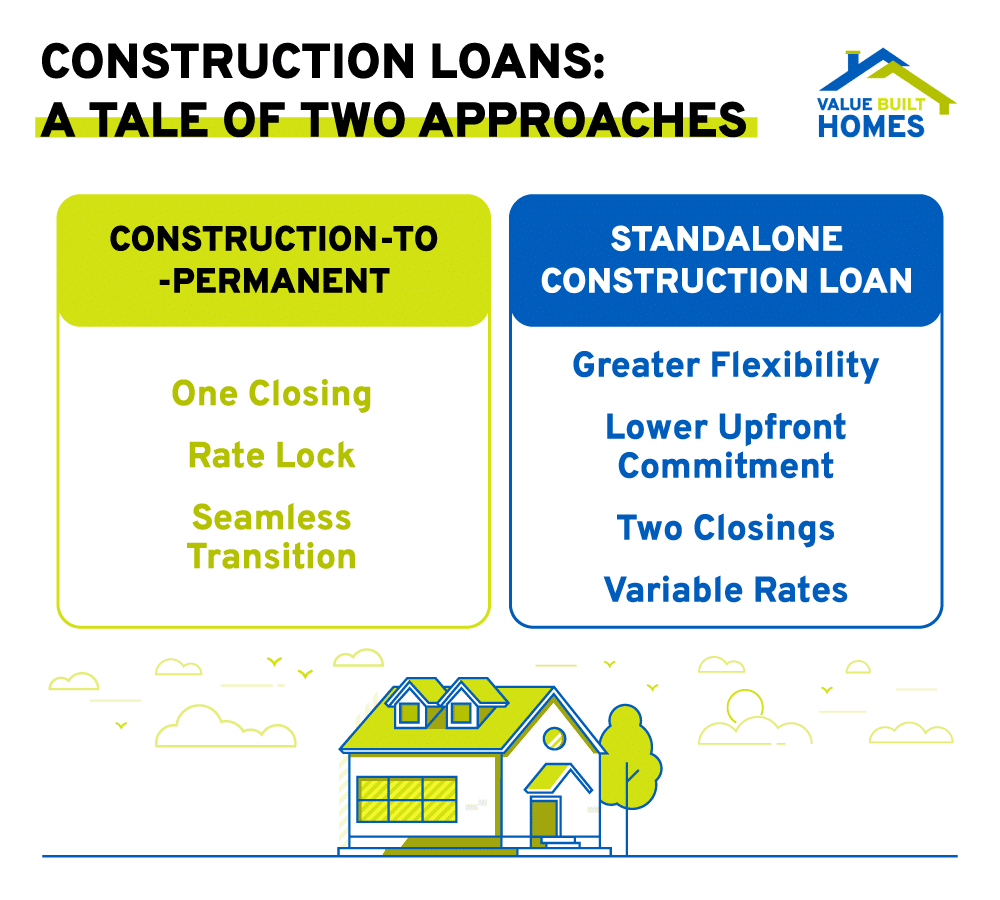

Choosing the right type of construction loan is crucial for financing your dream home. Each option offers unique benefits and considerations that align with your specific needs, goals, and circumstances.

Construction-to-Permanent Loans

Construction-to-permanent loans are an all-in-one financing option that simplifies the borrowing process. This type of loan begins as a construction loan and automatically transitions into a standard mortgage once your home is complete.

- Advantages:

- Single Closing: Save time and money on fees with one closing process.

- Locked-In Rates: Secure your interest rate at the start to avoid future hikes.

- Seamlessness: Smooth transition from construction to permanent financing.

- Why It’s a Good Fit for Value Built Homes: Value Built Homes’ efficient construction timelines align well with construction-to-permanent loans, supporting a streamlined financial transition from building to owning your home.

Standalone Construction Loans

Standalone construction loans cover only the building phase. Once your home is finished, you’ll need to apply for a separate mortgage to pay off the construction loan.

- Advantages:

- Greater Mortgage Shopping Flexibility: Shop for competitive mortgage rates post-construction.

- Lower Initial Requirements: Sometimes fewer upfront financial commitments.

- Challenges:

- Two Closings: Face the costs and time commitments of separate loan closings.

- Variable Rates: Interest rates may change between construction and mortgage phases.

- Why It’s Worth Considering: While requiring more effort, Value Built Homes’ transparent pricing and streamlined workflow can help manage the process, making this loan type a viable option for those who prefer flexibility in their financing options.

Aligning Loan Types with Value Built Homes

At Value Built Homes, our building process is designed to complement various construction loan types. While we emphasize transparent pricing and efficient workflows, it’s important to note that customer experiences may vary. We aim to support our customers through clear communication and structured processes to align financing with construction milestones.

- Streamlined Process: Our approach ensures that financing aligns smoothly with construction milestones, though individual experiences may differ.

- Faster Build Times: Quicker completion can reduce the time you spend paying interest during the construction phase.

- Energy-Efficient Homes: Incorporating energy-efficient designs can help qualify for favorable loan terms, though specific outcomes depend on individual lender policies and the particular features of each build.

Benefits of Using Construction Loans

Construction loans provide several unique advantages for building a home from the ground up, catering specifically to the needs of home construction.

Financing That Aligns with Construction Milestones

- Targeted Disbursements: Funds are released at each major construction step, ensuring you only pay for completed work and keeping the project financially on track.

- Interest Savings: Charged only on funds already disbursed, helping manage cash flow and minimize financial strain during the building phase.

Flexibility to Customize Your Dream Home

- Personalization Options: Build a house tailored to your lifestyle and preferences, from layout designs to material choices.

- Energy-Efficient Features: Integrate modern, energy-saving technologies to reduce your home’s environmental impact and utility bills.

Controlled Borrowing for Better Budget Management

- Transparency and Cost Control: Detailed budgets help avoid overborrowing. Value Built Homes’ pre-priced, standardized floor plans provide upfront clarity on costs, simplifying loan applications.

- Collaborative Planning: Clear building plans and itemized budgets encourage accountability throughout construction.

A Seamless Fit with Value Built Homes’ Simplified Process

Value Built Homes maximizes the benefits of construction loans by ensuring a smooth and stress-free building experience:

- Hassle-Free Budgeting: Transparent pricing makes it easy to determine financing needs.

- Quick Construction Times: Faster builds mean less time paying interest and moving into your home sooner.

- Professional Partnerships: We work with experienced lenders to make obtaining a construction loan as easy as possible.

Construction loans empower you to take control of the building process, turning your vision into reality with confidence and financial stability.

Important Considerations When Applying for a Construction Loan

Applying for a construction loan requires preparation and attention to detail to ensure a smooth process. Here are the key considerations to keep in mind:

Establishing Financial Eligibility

- Credit Score: A minimum score of 580 is typically the baseline for eligibility, though higher scores often lead to more favorable loan terms.

- Debt-to-Income Ratio: Lenders generally prefer a ratio below 36%. However, ratios up to 45% are sometimes acceptable, depending on lender guidelines and project factors.

- Down Payment: A down payment of at least 20% of the project cost is commonly required. Some lenders may ask for up to 25%, particularly for more complex builds.

Creating Comprehensive Plans and Budgets

- Detailed Budget: Break down all costs, including land purchase, construction materials, labor costs, permits, insurance, and contingency funds for unforeseen expenses.

- Building Plans: Provide finalized plans covering design, materials, and construction timelines.

- Value Built Homes Advantage: Our pre-designed, standardized floor plans offer transparency in pricing, simplifying cost estimates for lenders.

Partnering with the Right Lender

- Expertise: Choose lenders experienced in construction financing and familiar with Value Built Homes’ processes.

- Competitive Terms: Compare interest rates, fees, and loan structures to find the best fit.

- Open Communication: Maintain clear and ongoing communication with your lender to ensure all requirements are met promptly.

Selecting the Right Location in Indiana

- Available Land Options: Explore communities like Baldwin Estates in Princeton or Willow Crossing in Evansville where Value Built Homes builds.

- Zoning Laws: Verify that the plot meets zoning laws, has utility connections, and accommodates your floor plan for a smoother loan approval process.

- Consider Additional Site Costs: Prepare for potential site preparation expenses like grading or septic system installation.

Preparing Necessary Documentation

- Financial Records: Gather tax returns, pay stubs, and bank statements.

- Builder’s Agreements: Provide contracts and detailed construction cost breakdowns.

- Plans and Timelines: Detail the project scope and schedule to demonstrate feasibility.

By focusing on these considerations, you can simplify the process of applying for a construction loan. Partnering with Value Built Homes further streamlines the experience, as our clear pricing, pre-designed floor plans, and structured processes aim to make loan approvals easier. With thorough preparation and the right team by your side, you’ll be one step closer to building your dream home.

Final Thoughts: Realizing Your Dream Home with Construction Loans

Building your dream home is an exciting milestone, and construction loans are a powerful tool to help make it a reality. These specialized loans provide the flexibility and structure needed to finance every aspect of home construction, from purchasing land to completing the final touches. By understanding how construction loans work and preparing thoughtfully, you can confidently navigate the process and stay in control of your project.

At Value Built Homes, we’re proud to be your partner on this journey. Our commitment to affordability, energy efficiency, and transparency ensures that your home-building experience is as smooth and stress-free as possible. With our pre-designed floor plans, quick construction timelines, and clear pricing, we simplify the entire process, making construction loans a viable option for achieving your dream.

Start building your dream home today! Contact Value Built Homes to explore our expertly designed floor plans, secure prime land in Indiana, and receive personalized support for your construction loan. Discover how our streamlined process and transparent pricing can make your home-building journey stress-free and affordable. Don’t wait any longer to build your dream home. Reach out to us now and take the first step towards affordable, energy-efficient living.