Deciding between renting and buying a home is one of the most significant housing decisions you’ll make. For individuals and families in Southwest Indiana, this choice can feel especially complex given the region’s mix of affordability, evolving market conditions, and community-focused living. Factors like your financial situation, lifestyle preferences, and long-term goals all play significant roles in determining the best path forward.

In this guide, we’ll explore the key differences between renting and buying in Southwest Indiana. We’ll offer insights into costs, flexibility, stability, and lifestyle considerations—all while acknowledging that the financial benefits of renting versus buying depend on individual circumstances. We will also discuss how Value Built Homes provides a streamlined and affordable option to help transform your homeownership dreams into reality.

Renting vs. Buying in Southwest Indiana: What You Should Know

Deciding whether to rent or buy is a major decision that requires careful thought, particularly in a region like Southwest Indiana. This area combines affordable living with steady growth, making it an attractive option for both renters and potential homeowners.

Local Real Estate Trends

According to the Indiana Association of Realtors, Indiana home prices rose 5% year-over-year in July 2025, reflecting an overall upward trend. While specific data for Southwest Indiana is not separately provided, many areas in the region may be experiencing similar gains. Despite fluctuating inventory and interest rates, Indiana’s property market has demonstrated resilience, supported by strong demand.

Affordability and Job Security

Residents of Southwest Indiana benefit from a lower cost of living, in addition to stable employment in critical sectors like healthcare, manufacturing, and education. According to the Indiana Business Research Center, affordability concerns are moderating the pace of home buying and new construction, but job availability continues to bolster housing demand. This climate can support fixed monthly mortgage payments for homeowners while providing renters with various leasing options.

The Financial Equation: A Head-to-Head Comparison

Financial considerations are central to choosing whether to rent or buy. Evaluating both immediate costs and long-term benefits can help you select the option that best aligns with your budget and goals.

The Cost of Renting

Renting entails predictable monthly expenses such as rent, renter’s insurance, and utilities. Although the initial outlay is lower and maintenance is typically handled by the landlord, renters do not build equity. Additionally, data from the National Association of Realtors indicates that rental prices can trend upward, impacting long-range budgeting.

The Cost of Homeownership

Purchasing a home usually requires a larger initial investment and ongoing costs like mortgage payments, property taxes, insurance, and upkeep. However, with a fixed-rate mortgage, your monthly payments remain relatively stable, and each payment gradually builds equity. Over the long term, this accumulation of equity can provide substantial financial advantages.

Why Ownership Can Be a Better Long-Term Investment

- Building Equity: Each mortgage payment increases your ownership stake in the property, ultimately turning your monthly outlay into an investment.

- Appreciation Potential: Many homes in Indiana, according to data from the Federal Housing Finance Agency, have appreciated in value over the past few years.

- Stability vs. Rising Rent: Fixed-rate mortgages offer predictable monthly expenses, unlike the variability of rental rates, which may rise with market conditions.

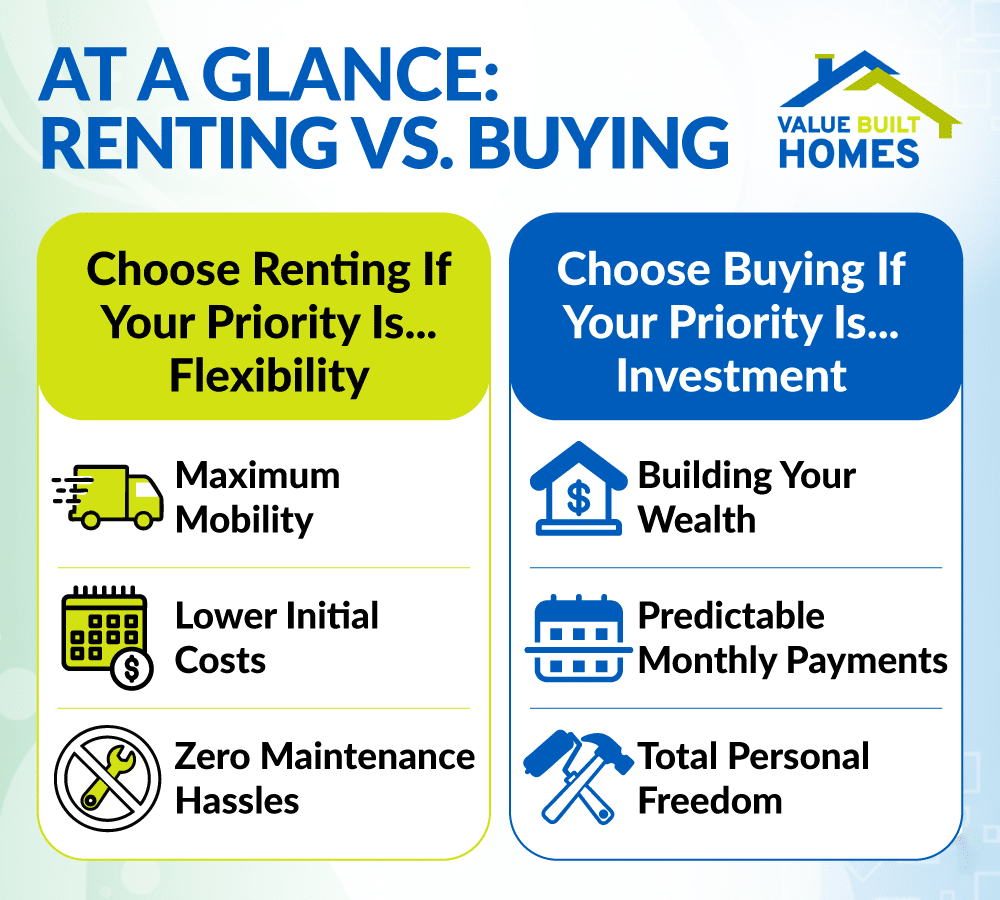

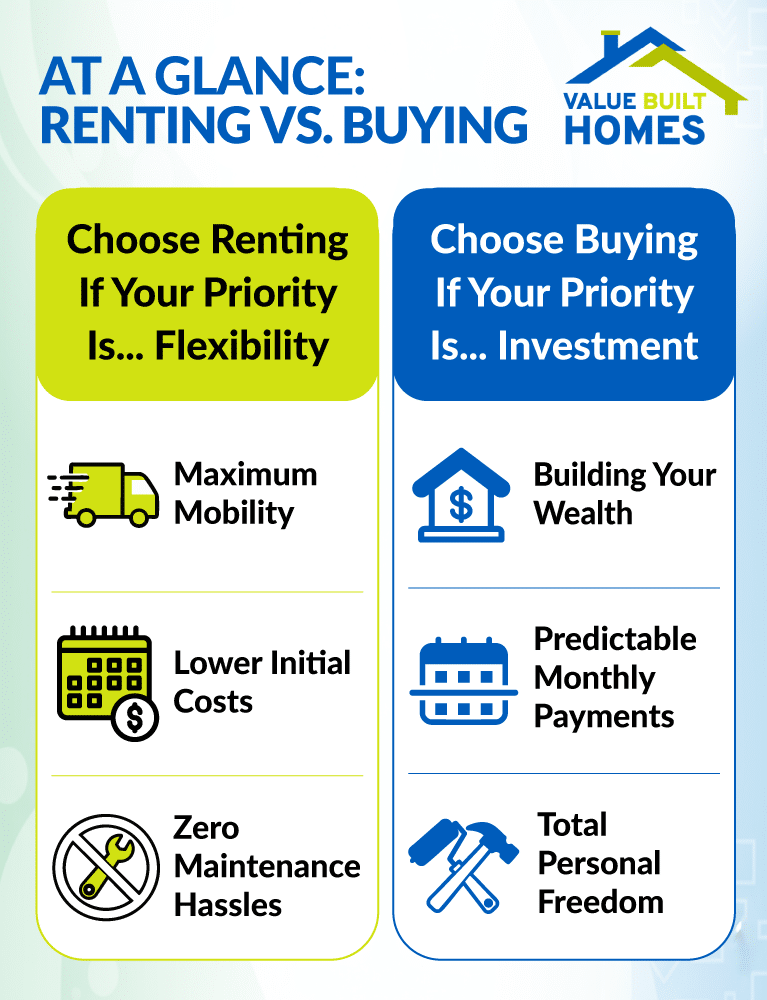

The Case for Renting: A Lifestyle of Flexibility and Convenience

For many individuals and families in Southwest Indiana, renting is the perfect choice, offering a lifestyle defined by freedom, lower initial costs, and fewer responsibilities. While it doesn’t build long-term equity, its advantages are compelling for those with specific priorities.

Unmatched Mobility and Freedom

The primary appeal of renting is the flexibility it affords. If you value mobility for your career or simply enjoy exploring different communities before settling down, a lease provides a clear and simple path to relocation.

- Adapt to Life Changes: Renting is ideal if you anticipate a job transfer, family changes, or simply aren’t ready for the long-term commitment of homeownership.

- Explore Neighborhoods: A short-term lease allows you to experience a neighborhood’s amenities and atmosphere firsthand before deciding to plant deeper roots.

- Avoid Long-Term Commitment: When your lease ends, you have the freedom to move on without the complex and costly process of selling a property.

Lower Upfront Costs and Fewer Responsibilities

Financially, renting presents a much lower barrier to entry. This accessibility, combined with predictable, hands-off maintenance, makes it a practical and stress-free option.

- Reduced Initial Investment: Your upfront cost is typically limited to a security deposit and the first month’s rent, which is significantly less than a down payment and closing costs on a home.

- No Maintenance or Repair Bills: One of the biggest perks of renting is that landlords are responsible for handling—and paying for—repairs, maintenance, and upkeep. This protects you from the cost of unexpected issues.

- Predictable Monthly Outlay: While rent can rise upon lease renewal, your core housing expenses are generally fixed for the term of your lease, simplifying your monthly budget.

The Case for Homeownership: Building Wealth and Planting Lasting Roots

For those with a long-term perspective, homeownership in Southwest Indiana is a powerful pathway to financial stability, personal freedom, and deep community connection. It transforms your monthly housing payment from a simple expense into a lasting investment in your future.

A Powerful Financial Investment

Unlike renting, owning a home is a strategic financial decision that builds wealth over time. This provides a level of security that renting cannot match.

- Build Equity with Every Payment: Each mortgage payment increases your ownership stake in the property, effectively turning your monthly outlay into a savings account that grows into a significant asset.

- Benefit from Appreciation: Over the long term, real estate in Indiana has historically appreciated in value, meaning your home could be worth more than you paid for it, further increasing your net worth.

- Lock in Stable Housing Costs: With a fixed-rate mortgage, your principal and interest payments will not change for the entire loan term. This offers stability and protects you from the unpredictable rent increases common in the rental market.

Ultimate Stability and Personal Freedom

Beyond the numbers, owning a home provides a sense of permanence and the freedom to create a space that is uniquely yours. This stability is the foundation for building a life connected to your community.

- Total Creative Control: Homeownership gives you the freedom to customize your living space. You can renovate the kitchen, add a new room, upgrade the landscaping, or simply paint the walls—all without needing a landlord’s permission.

- Establish Deep Roots: Owning your home allows you to settle into a community for as long as you wish. This permanence helps you forge deeper neighborhood connections and provides a stable environment for yourself and your family.

- Security and Certainty: You will never face the possibility of a landlord deciding to sell the property or raising the rent beyond your means, giving you ultimate control over your future housing situation.

Debunking Common Homeownership Myths

Several myths about owning a home often deter potential buyers. Let’s address these concerns:

Myth 1: I Need to Be Wealthy to Buy a Home.

In reality, numerous financing programs offer manageable down payments. Many first-time buyers are eligible for loans that don’t require prohibitively high initial costs.

Myth 2: Building a Home Is Too Complicated.

Value Built Homes relies on standardized designs, sparing buyers from the maze of decision-making that typically comes with custom builds.

Myth 3: Owning a Home Means Constant Repairs.

New homes utilize modern materials and energy-efficient construction, significantly reducing the frequency and cost of maintenance compared to older properties.

Myth 4: Homeownership Will Eliminate My Flexibility.

If circumstances change, you can still sell or rent out a home, preserving a measure of flexibility. Moreover, the Indiana Association of Realtors provides programs and information to guide potential sellers or landlords.

Myth 5: Renting Is Always More Economical.

While the initial costs of renting can be lower, you don’t build equity. Over time, ownership can offer significant financial rewards, though outcomes vary by individual financial circumstances and market forces.

The Smart Solution for Southwest Indiana: Value Built Homes

For prospective buyers in Southwest Indiana, Value Built Homes offers several benefits that simplify homeownership:

- Affordable Homebuilding Through Standardization: By using standardized floor plans, construction costs are more easily controlled, keeping homes both affordable and high in quality.

- Reliable, High-Quality Construction: Each home goes through a consistent process, ensuring it meets strict quality standards and giving you peace of mind about the final product.

- Simplified and Low-Stress Homebuilding: A clear, step-by-step approach removes many complexities linked to custom homebuilding, making the experience more transparent and manageable.

- Faster Move-In Times: An efficient construction model can shorten build times and grant you home ownership sooner.

- Diverse Floor Plan Options: With designs spanning two to five bedrooms, you can choose the layout that best fits your household and budget.

- Strategic Land Locations: Value Built Homes connects you to prime locations in Southwest Indiana, ensuring your new home stands on desirable property in a community that supports your long-term ambitions.

Your Path from Renter to Homeowner

Transitioning from renting to owning a home in Southwest Indiana can be smooth if you plan methodically. Begin by gauging your finances—consider your credit score, savings, and how mortgage terms will fit your budget. This step clarifies your price range and preps you for realistic expectations.

Then, consult financial advisors knowledgeable about the U.S. Census Bureau data or local first-time buyer programs, which can illuminate potential tax benefits and down payment assistance. Because the housing market can shift quickly, keeping an eye on trends from resources like the Indiana Department of Workforce Development can help you time your purchase advantageously, especially if a new job or relocation is part of your plan.

If you need flexibility before commitment, consider short-term renting to evaluate different communities and factor in your lifestyle needs. When you’re ready to build, a trusted partner like Value Built Homes can ensure your floor plan, location, and overall construction journey feel straightforward and rewarding.

Deciding What’s Right for You: Renting vs. Buying

Choosing between renting and buying depends on various factors. Reflect on these questions:

- What Are Your Financial Goals? Do you want to build long-term wealth through equity, or is the flexibility and lower initial cost of renting more appealing?

- What Is Your Timeframe? Will you settle in one area for years, or do you envision relocating?

- How Do You Feel About Maintenance? Are you comfortable handling or outsourcing repairs, or do you prefer a landlord managing them?

- Which Lifestyle Suits You Best? Does the freedom to move appeal to you, or does putting down roots in a stable community resonate more?

For many who lean toward homeownership, Value Built Homes provides an affordable, low-stress opportunity. Their process is designed to help you move into a customized, high-quality property that aligns with both your budget and lifestyle.

Making the Right Choice for Your Future

Deciding between renting and buying in Southwest Indiana depends on your finances, preferences, and long-term plans. Renting often means lower upfront costs and greater flexibility, while buying offers the perks of equity buildup and stable monthly expenses over time. Both paths have merit, and the best choice ultimately aligns with your individual situation and local market dynamics.

If you’re considering homeownership, Value Built Homes simplifies the process through efficient, high-quality construction and standardized floor plans. This approach lets you tap into the potential for equity growth and long-term stability. Contact Value Built Homes to discover a stress-free path forward in your journey from renting to owning.