Buying a newly built home is a thrilling milestone. From choosing the right floor plan to watching construction progress, every step brings you closer to homeownership. However, the final step—the closing process—can feel intimidating. Understanding what’s involved makes this stage manageable and even empowering.

The new-build closing process finalizes all legal, financial, and administrative arrangements so that your new home is officially yours. At Value Built Homes, a trusted Indiana builder specializing in affordable, energy-efficient homes, we simplify this process. In this guide, we break down the essential steps of the new-build home closing process and offer actionable advice—from preparing for closing costs to conducting a final walkthrough—so you enter closing day with confidence.

What Is the Closing Process for a New-Build Home?

The closing process is the final step in homeownership, where all legal and financial matters are settled. Instead of dealing with an existing home’s uncertainties, new constructions involve coordinated efforts among your lender, builder, and title company. This collaboration ensures that the purchase price, loan terms, and property conditions meet the agreed terms before the keys are handed over. It confirms that the home’s title is free of liens and that all obligations—such as mortgage finalization and property inspections—are met.

Differences with existing homes can include delays related to construction or inspections and unique warranties offered by builders. Completing the closing provides legal certainty, ensuring the home is delivered as promised and ready for you to move in.

Preparing for the Closing Process

Effective preparation is key to a smooth closing. Begin organizing your finances, gathering necessary documents, and connecting with involved professionals weeks before your closing date.

Understanding and Estimating Closing Costs

Closing costs include lender fees, title and escrow services, property taxes, document preparation, and sometimes additional fees specific to new construction. Work with your lender to review your loan estimate and later the closing disclosure. Address any discrepancies immediately to avoid last-minute surprises.

Gathering the Necessary Documents

Ensure you have all required paperwork before closing. Key documents include the:

- Purchase Agreement

- Loan Documents (including the Loan Estimate and Closing Disclosure)

- Proof of Homeowner’s Insurance

- Inspection Reports

- Builder’s Warranties.

Confirm that any contract changes during construction are accurately reflected.

Who You’ll Be Working With

Key players in this process include:

- Your Mortgage Lender – for financing details and fund disbursement.

- The Title Company – to clear the title and record the transaction.

- The Builder – to verify home completion and warranty details.

- A Closing Agent or Attorney – to manage document signing and legal obligations.

Clear communication with each party helps keep the process efficient.

Final Walkthrough Before Your New-Build Closing

The final walkthrough is your last chance to inspect your new home before closing. This step confirms that the property meets all agreed-upon standards and that any minor issues are noted and addressed.

Scheduled a few days before closing, the final walkthrough verifies that construction is complete and that any agreed upgrades or repairs have been completed or noted for follow-up. It ensures that your new home meets all expectations before you commit.

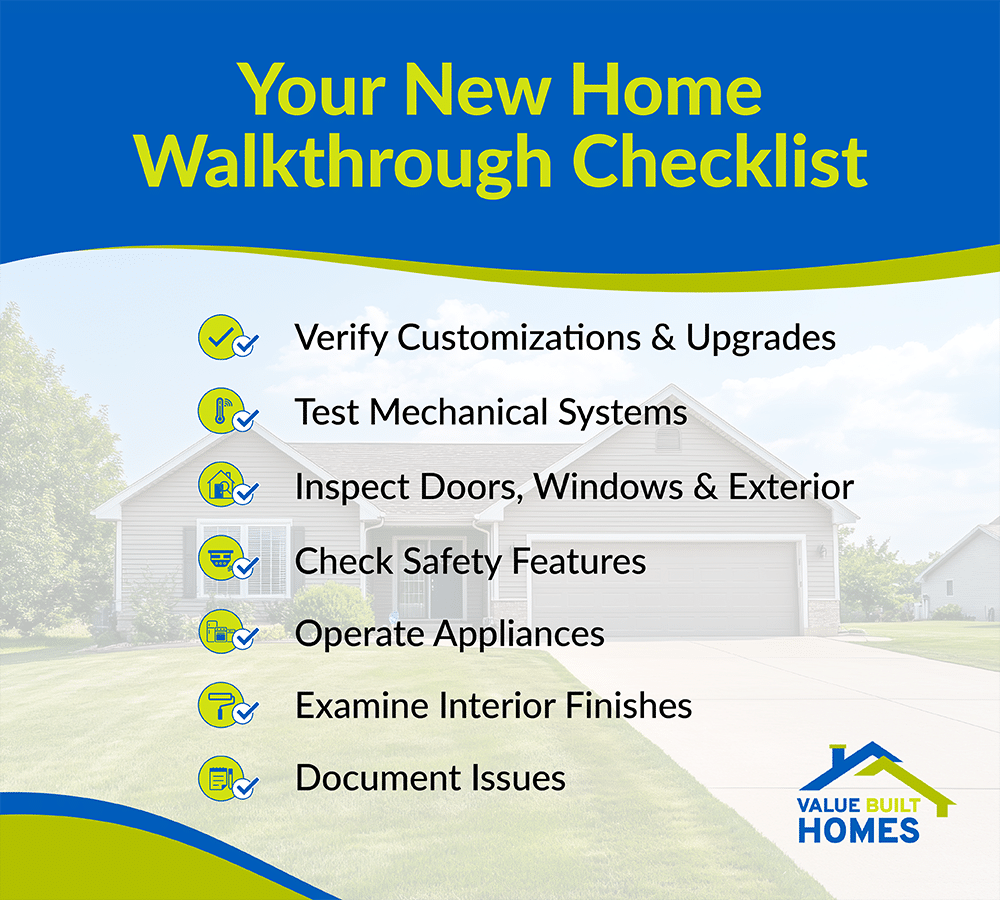

Your Walkthrough Checklist

During the walkthrough, focus on:

- Customizations and Upgrades: Verify that all agreed-upon changes and enhancements are completed exactly as detailed in your contract, ensuring you receive what you paid for and preventing future disputes.

- Mechanical Systems: Thoroughly test heating, cooling, plumbing, and electrical systems to confirm they are functioning correctly for basic living needs and long-term comfort, preventing costly repairs or discomfort after moving in.

- Doors, Windows, and Exterior: Inspect doors, windows, and exterior features to guarantee proper sealing against weather, security against intrusion, and the intended aesthetic appeal of the home’s exterior.

- Safety Features: Confirm the presence and functionality of essential safety devices like smoke detectors, carbon monoxide detectors, and GFCI outlets in appropriate locations to protect your family from hazards.

- Appliances (if included): Operate all included appliances such as ovens, refrigerators, dishwashers, washers, and dryers to ensure they are properly installed, functioning as expected, and free from damage.

- Interior Finishes: Carefully examine walls, ceilings, floors, paint, trim, and cabinetry for any blemishes, inconsistencies, or incomplete work, ensuring a high-quality and aesthetically pleasing interior as expected.

- Punch List: Understand the procedure for submitting your documented issues, including deadlines and responsible parties, to ensure a clear path for resolution and timely repairs. Meticulously document any identified issues with detailed notes and accompanying photographs to create a comprehensive “punch list” that clearly communicates required corrections to the builder or seller.

If minor issues are discovered, note them for resolution. For major concerns, arrange for repairs before closing or document an agreement for post-closing resolutions.

Signing and Reviewing Closing Documents

After a satisfactory walkthrough, it’s time to sign the documents that legally transfer ownership. Careful review of the paperwork is essential.

Key Documents to Understand

You will review:

- Deed: Transfers property ownership; verify property details and name accuracy.

- Closing Disclosure: Outlines finalized loan terms and closing costs.

- Promissory Note: Details your mortgage repayment terms.

- Title Insurance Policy: Protects against title disputes.

- Builder’s Warranties: Lists guarantees for home components and systems.

Review these with your lender or attorney and clarify any unfamiliar terms, such as “escrow” or “amortization,” to ensure you understand your commitments.

Tips for a Smooth Closing Day

On closing day, staying organized and proactive will help you navigate this final phase smoothly.

What to Bring

Come prepared with:

- A government-issued ID.

- Proof of Homeowner’s Insurance.

- A cashier’s or certified check for any required payments.

- Any additional documents your lender has requested.

Preventing Last-Minute Surprises

Double-check the Closing Disclosure for accuracy. Maintain open communication with your lender, builder, and closing agent throughout the day. If necessary, arrange for a power of attorney if you cannot attend in person.

Receiving Your Keys

After all documents are signed and payments are made, you receive your keys—a moment that marks the official start of your homeownership. Take a moment to celebrate this achievement, knowing you’ve accomplished every step with careful planning.

How Value Built Homes Simplifies the Closing Process

At Value Built Homes, we focus on a streamlined, transparent process that makes closing on a new home worry-free.

Streamlined Floor Plans and Timely Construction

Our standardized floor plans reduce decision fatigue and keep construction on schedule, minimizing delays that could affect your closing date. With predictable timelines, you know what to expect from start to finish.

Energy-Efficient Construction

Our homes are built with advanced energy-efficient practices, reducing future utility costs and minimizing defects identified during the final walkthrough.

Dedicated Customer Support

Our knowledgeable team provides ongoing updates and guidance, helping you confidently navigate everything from document preparation to problem resolution at closing.

Transparent Communication

We maintain clear communication between all parties—lenders, title companies, and builders—to ensure every detail is aligned, making your closing predictable and stress-free.

Transitioning to Homeownership After Closing

Once you have closed on your home, a few essential post-closing tasks will ensure a smooth transition.

Essential Post-Closing Tasks

Immediately transfer utilities, file all important documents safely, and review any remaining warranty information provided by your builder. This organization sets you up for successful long-term home management.

Settling Into Your New Home

Make initial adjustments such as setting up your thermostat and familiarizing yourself with energy-efficient features. Adapting these habits from the start can help you manage costs and maintain comfort.

Planning for Maintenance

Create a maintenance schedule for tasks like HVAC filter replacement and window inspection. Regular upkeep will help preserve the quality and efficiency of your home.

Navigating Unexpected Challenges During the Closing Process

Even with thorough preparation, unexpected challenges can arise during the closing process. Some homebuyers may encounter delays in final document approvals or last-minute discrepancies in closing costs. It is essential to remain flexible and proactive during these moments. For example, if your lender identifies a mismatch in fees or discrepancies within your Loan Estimate, contacting them promptly can resolve the issue before it escalates. Additionally, during the final walkthrough, you might spot unexpected minor defects that were overlooked. In such cases, having an open line of communication with your builder is crucial. Together, you can negotiate quick resolutions or arrange for post-closing fixes that do not derail your plans.

Staying informed about potential hiccups, maintaining organized records of communication, and understanding your contractual rights will empower you to address challenges confidently. Taking the time to review every stage and verify details can prevent many common setbacks and ensure that your closing process remains on schedule.

Frequently Asked Questions About Your New-Build Home Closing

Many homebuyers have common questions about the closing process.

What should I do if unexpected fees appear at closing?

Just when you think you’re crossing the finish line to your dream home, closing day can sometimes throw an unexpected curveball: surprise fees. It’s understandable to feel a jolt of stress when you’re presented with charges you weren’t anticipating, but don’t panic! The first and most crucial step is to stay calm and resist the pressure to sign anything immediately. Instead, immediately ask for a clear and detailed explanation of each unexpected fee. What exactly is it for? Why is it being charged now?

Then, armed with this clarification, pull out your Loan Estimate and, most importantly, your Closing Disclosure. Carefully compare these documents to the new charges. Is the fee listed anywhere? If it is, was it within the estimated range, or is this a significant jump? If the fee is completely new and nowhere to be found in your previous paperwork, that’s a major red flag. Don’t hesitate to question the legitimacy of the fee, especially if it sounds vague or like it might be duplicating another charge.

How do I handle negotiations if repairs or issues are found during the final walkthrough?

Finding issues at this stage can feel like a punch to the gut, but don’t panic! This is exactly why the final walkthrough exists – it’s your last chance to address any problems before you officially become the homeowner. The absolute first thing to do?

Stop and document everything. Seriously, whip out your phone and become a photo and video journalist of these issues. Take close-ups, wide shots, narrate what you’re seeing – the more detailed your evidence, the better. Then, immediately get your real estate agent in the loop. They’re your experienced guide in this process and can advise on the best strategy. Share all your documentation with them; they’ll need the ammunition to advocate for you.

Now, take a breath and think strategically. Is this a minor cosmetic thing, or something more serious? Categorize the issues in your mind and focus your energy on the bigger, more impactful problems – especially anything safety-related or something that goes against what was agreed upon in your contract or inspection negotiations. When it comes to actually negotiating, you need to decide what you realistically want.

Be reasonable, prioritize your must-haves, and remember that negotiation is a two-way street. Your agent will then communicate your findings and proposed solutions to the seller’s side. The key here is to negotiate in good faith – be willing to compromise, understand the seller’s potential perspective (they’re likely stressed about closing too!), and keep the tone professional and calm. Once you reach an agreement – and hopefully you will! – make sure it’s documented in writing as an amendment to your purchase agreement.

What does the timeline look like after signing the closing documents?

Typically, once the paperwork is complete and payments are processed, keys are handed over on the same day; however, some transactions may require an additional day for final confirmations. Clear communication during each phase helps set realistic expectations and minimizes uncertainty. Ensuring you are well-prepared with answers to these common questions can greatly reduce stress and keep the process moving smoothly.

A Confident Closing: Your Value Built Homes Advantage

Reaching closing day on your newly built home marks the exciting culmination of your homeownership journey, and with Value Built Homes, it’s a journey paved with confidence and ease. With Value Built Homes, you can approach closing day with genuine confidence, knowing our streamlined processes, transparent communication, and predictable timelines are designed to make each step—from initial planning to the final walkthrough—smooth and straightforward.

Value Built Homes’ commitment to affordable, energy-efficient homes in prime Indiana locations, coupled with our simplified processes and reliable support, transforms the closing process from a potentially stressful hurdle into a genuinely rewarding milestone. By choosing Value Built Homes, you’re not just getting keys to a new house; you’re gaining a partner dedicated to making your dream of affordable, quality homeownership a reality, right through to a confident and satisfying closing day.

If you’re ready to make your dream of owning a new home a reality, explore our unique floor plans and available land options across Indiana. Contact Value Built Homes today for a smooth, hassle-free closing experience that sets the stage for years of happy homeownership.