Building your dream home is one of life’s most rewarding experiences—especially when you choose a builder and lending option that helps simplify the process. Construction-to-permanent financing combines construction costs and a long-term mortgage into a single loan. This approach can streamline your financing process by eliminating the need to secure separate loans and schedule multiple closings. If you are an Indiana homebuyer seeking affordability, efficiency, and simplicity, this type of financing may be an ideal solution.

In this guide, we break down the essential details of construction-to-permanent financing, answer common questions, and explain how it can help make your path to homeownership more straightforward—especially when you partner with a trusted homebuilder like Value Built Homes.

Understanding Construction-to-Permanent Financing for Your New Home

Constructing a new home typically involves multiple stages, from purchasing land to applying finishing touches, and financing is one of the earliest—and often most daunting—decisions to tackle. Construction-to-permanent financing offers a streamlined solution by merging the short-term construction loan with the long-term mortgage into a single loan structure. Traditionally, prospective homeowners might first apply for a short-term construction loan and then secure a separate mortgage after the home is completed, each requiring its own approvals, closings, and fees.

With the combined approach of construction-to-permanent financing, you can complete one approval and one closing, potentially reducing fees and paperwork. During the building phase, funds are released in stages (often called “draws”), and the loan automatically transitions into a long-term mortgage once the home is complete. This model is especially beneficial if you wish to lock in your loan terms from the outset, offering predictability in an environment with fluctuating interest rates.

At Value Built Homes, we understand the importance of keeping your project on schedule and within budget. Our standardized floor plans and streamlined construction process are designed to work in harmony with construction-to-permanent loans. This focus on a single, seamless closing and eliminating duplicate procedures contributes to a more predictable and stress-managed building experience, simplifying your journey to a new home.

How Does Construction-to-Permanent Financing Work?

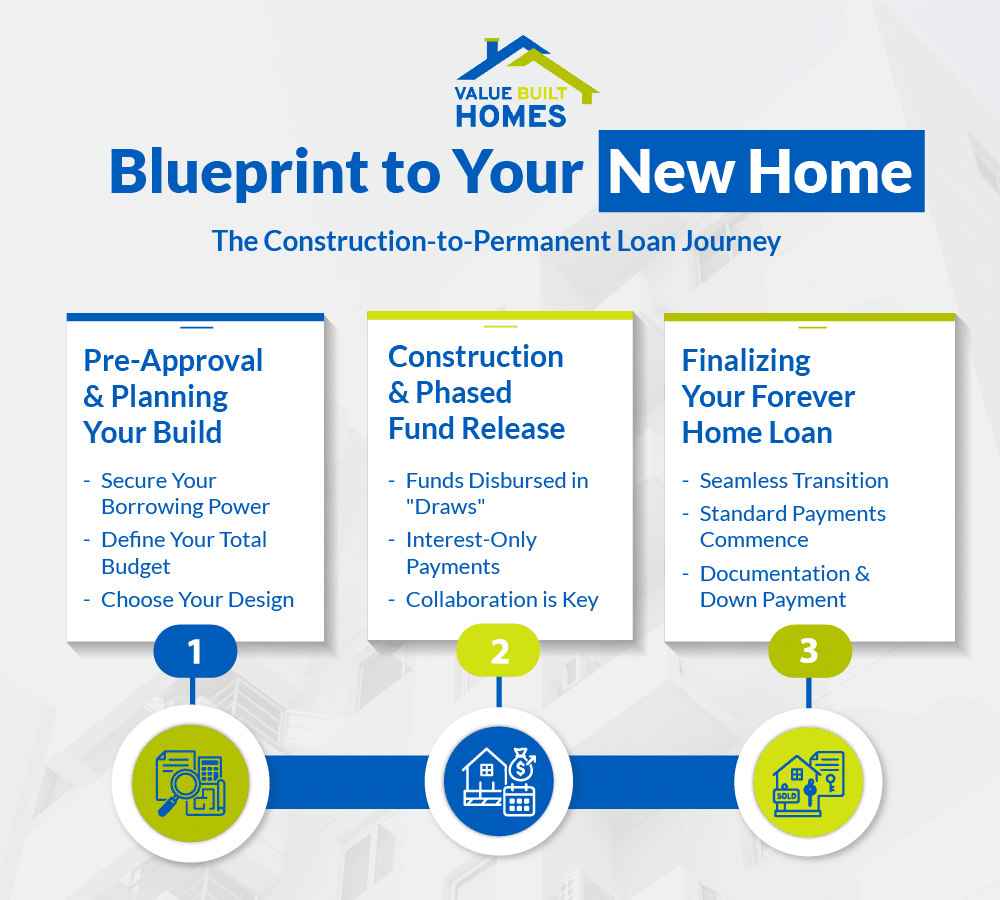

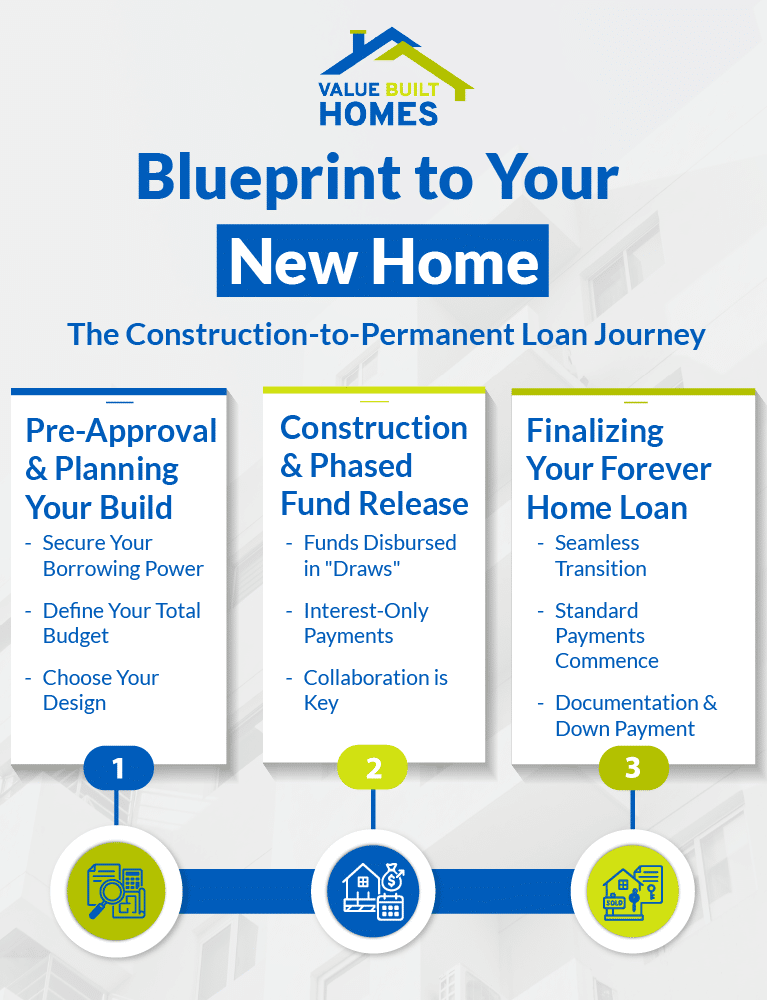

The process can be divided into three main components:

1. Pre-Approval and Determining Your Budget

Before the building process begins, you’ll go through a pre-approval stage. Lenders evaluate your credit, employment history, and financial situation to estimate how much you can borrow. This amount should factor in land acquisition, site preparation, and other building costs. Prospective borrowers can learn more about getting pre-approved in advance by reading how to get preapproved for a mortgage.

Once you have your loan amount, you’ll choose a floor plan. Value Built Homes offers a range of affordable, standardized designs—from cozy to expansive—to suit individual or family needs. Our straightforward floor plans help you and your lender see costs clearly from the start.

2. Disbursement of Funds During Construction

Rather than receiving all the funds at once, lenders release money in stages called “draws” as various milestones are met (for example, finishing the foundation or framing). During construction, borrowers typically make interest-only payments based on the current drawn amount. Clear communication among you, your lender, and your builder ensures that each draw corresponds with completed work.

Because Value Built Homes follows a standardized building process, we can maintain a consistent schedule of construction milestones. This consistency helps reduce the likelihood of delays and ensures that your project stays on track.

3. Transition to a Permanent Mortgage

Once construction is complete and your home meets local building requirements in Indiana, your loan converts to a longer-term option, such as a 30-year mortgage. You’ll switch from interest-only payments to typical monthly mortgage payments, which usually begin shortly after the construction phase ends. Borrowers can often choose between a fixed rate or an adjustable rate mortgage.

Lenders generally require comprehensive documentation—including construction plans and construction contracts—as part of the approval process. Down payments of around 20% are common (though these may vary); if you already own the land, its value can often contribute to your equity, potentially simplifying the process further.

Benefits of Construction-to-Permanent Financing

Simplified Loan Process

With a single application, one approval, and one closing, you reduce administrative tasks and avoid duplicate fees. This consolidated loan structure minimizes complexities, letting you concentrate on customizing your new home rather than on paperwork.

Cost Savings

Eliminating the need for separate loans means that you avoid paying closing costs twice. Additionally, locking in an interest rate early can protect you from potential market increases during the construction phase.

Predictable Terms and Budgeting

During construction, you typically make interest-only payments on the funds that have been disbursed. Once construction is complete, the loan seamlessly converts to a permanent mortgage with stable, predictable terms—simplifying long-term financial planning.

Flexibility for Modifications

If your builder accommodates minor design adjustments during construction, this financing method can ease the incorporation of such changes—as long as the costs remain within your approved budget. It is important to discuss any intended modifications with both your lender and builder so that any necessary adjustments to the financing structure can be arranged.

Reduced Stress

A cohesive financing process can contribute to a smoother homebuilding journey. Clear communication between your lender and builder helps ensure that any adjustments during construction are managed efficiently.

Common Questions About Construction-to-Permanent Loans

What Are the Interest Rates Like?

Interest rates depend on market conditions and your creditworthiness. Typically, the rates during the construction phase may be somewhat higher, but once converted, competitive terms for a long-term mortgage can be locked in.

Is a Down Payment Required?

Yes, a down payment—often around 20%—is generally required for these loans. The exact amount depends on your financial profile and lender policies. Some government-backed programs may offer lower requirements. If you already own the land, its equity might reduce the cash needed upfront.

How Do Monthly Payments Work During Construction?

During construction, you usually make interest-only payments based on the drawn amount, helping to keep your monthly costs lower until the home is finished.

What If There Are Construction Delays?

Unexpected delays caused by severe weather, supply chain issues, or other disruptions can affect your timeline. While the flexible terms of construction-to-permanent financing may offer some options to address delays, it is essential to confirm with your lender whether specific extensions are applicable for weather-related disruptions.

Which Documents Are Typically Required?

Expect to provide detailed floor plans, cost breakdowns, and a signed contract with your builder. These documents confirm that all parties are aligned on the budget, scope, materials, and construction timeline.

Can I Make Changes to the Design After Loan Approval?

Minor changes might be possible if they stay within the approved budget. Discuss all potential modifications with both your lender and builder in advance to avoid jeopardizing your loan terms or project timeline.

What Happens if My Financial Situation Changes During Construction?

Notify your lender immediately if you experience significant financial changes. They might re-evaluate your loan terms or offer solutions to ensure your project remains financially viable.

Can Construction-to-Permanent Loans Offer Energy Efficiency Incentives?

Some lenders provide incentives for including energy-saving features in your home. Inquire about available programs that might offer reduced interest rates or grants for eco-friendly construction practices.

Challenges and Misconceptions About Construction-to-Permanent Financing

Misconception: It Is Too Complex

Though the process might initially seem complicated, construction-to-permanent financing simplifies matters by merging what would otherwise be separate loans. A single, well-defined process from construction to a permanent mortgage can ease the overall building journey.

Misconception: Higher Initial Costs

While the construction phase might involve slightly higher interest rates or a significant down payment, locking in favorable terms for the permanent loan can ultimately lead to overall savings—eliminating the need to secure and close on a second loan.

Managing Delays

Any building project can face unforeseen challenges. Close coordination with your builder and proactive communication with your lender are key to managing delays without severe financial impacts.

Preparing Your Finances for Construction-to-Permanent Financing

Building a Strong Credit Profile

A robust credit score can help secure favorable loan terms. It’s advisable to review your credit report, reduce outstanding debts, and address any inaccuracies before applying.

Budgeting for the Unexpected

Even with a streamlined loan process, setting aside contingency funds is wise in case of unforeseen expenses—be it due to design modifications or material price hikes.

Maintaining Organized Documentation

Keep detailed records—from project documentation to invoices—to expedite lender approvals and ensure that all stakeholders, including Value Built Homes and your lender, are on the same page.

Indiana-Specific Considerations

According to the Indiana Department of Homeland Security, local building codes and regulations may vary significantly. Building in Indiana could involve unique ordinances, permitting processes, or specific land preparation requirements. Additionally, the Indiana Department of Local Government Finance offers guidance on property taxes, which may influence your monthly mortgage budgeting. Value Built Homes is committed to guiding you through these Indiana-specific steps to keep your construction and financing aligned with local conditions.

It is also important to consider Indiana’s seasonal weather. Winter cold snaps or rainy springs can potentially slow progress. While construction-to-permanent financing is known for adaptable terms, borrowers should verify with their lender whether contract extensions are available when weather-related delays occur.

Planning for Unexpected Events During Construction

Even with thorough planning, construction projects can encounter unplanned obstacles. Being prepared can make a significant difference.

Preparing for Project Delays

Severe weather or unexpected challenges can delay your timeline. Maintain open communication with your builder, and if delays occur, contact your lender to discuss potential adjustments in your draw schedule or loan terms.

Adjusting Budgets on the Fly

Material costs may increase or unforeseen site conditions may require additional work. Financial flexibility and preparedness can help you handle these changes without major disruptions.

Establishing a Risk Management Strategy

Having robust insurance and designated contingency funds acts as a safety net, ensuring that unexpected overruns or damages do not derail your overall project.

Tips for Selecting a Construction-to-Permanent Loan

Compare Multiple Lenders

Review interest rates, fees, and other terms from different lenders. Not all institutions manage construction loans the same way, so obtaining multiple quotes can help you find the best fit for your project. Fannie Mae’s construction loan guidelines can also offer insight into eligibility and documentation requirements.

Evaluate Loan Terms

Examine the length of the construction phase, rate lock options, and policies regarding project delays. Understanding these terms is essential to avoid unforeseen fees or complications.

Prepare Comprehensive Documentation

Organize all necessary paperwork—including building plans, detailed cost estimates, and a draw schedule—to expedite the approval process and minimize misunderstandings as your project progresses.

Involve Your Builder from the Start

A builder’s expertise is crucial in meeting construction milestones and securing timely funding draws. Value Built Homes collaborates closely with lenders to ensure that every draw is executed correctly and that the transition to a permanent mortgage proceeds smoothly.

Additional Considerations for Successful Financing

Select a lender who offers responsive customer service and has a proven track record with construction projects in Indiana. Exploring options like Freddie Mac’s construction conversion mortgages can also provide clarity on available financing strategies. Additionally, consider feedback from previous clients to gauge a lender’s reliability.

Choosing the Right Home Builder

While the financial aspects are critical, partnering with a reputable and experienced builder is equally essential:

- Look for a proven record of on-time completions.

- Seek clear cost estimates from the outset.

- Check reviews and references to assess customer satisfaction.

Value Built Homes offers Indiana families high-quality, affordable homes built with standardized floor plans that prioritize efficient, predictable construction.

Embrace a Seamless Home Building Experience with Construction-to-Permanent Loans

Construction-to-permanent financing unites two critical phases—construction and a long-term mortgage—into one streamlined loan. This integrated structure can save time and money while providing clarity throughout the building process. Paired with Value Built Homes’ dedication to quality and affordability, this financing solution can help guide you smoothly from planning to moving in your new home.

If you’re ready to explore building your new home in Indiana and want expert support at every phase, reach out to Value Built Homes. We’re here to help you navigate construction-to-permanent loan options and achieve your dream home.