Building a new home in Indiana is exciting—but the money side of it can feel confusing, especially if this is your first time working with a construction loan. You might wonder: When does my builder actually get paid? What am I paying during construction? How do I know my money is protected?

That’s where construction draws come in. They’re the backbone of how your lender, your builder, and you stay aligned on progress, payments, and quality throughout the build. When used well, they help keep your project on budget, reduce surprises, and make it easier to plan your monthly finances while your home is being built.

In this guide, we’ll show you how construction draws fit into your overall financing, when and how your builder is paid, what your payments look like at each stage, and how Value Built Homes uses a clear, milestone-based process to make building an affordable, site-built home in Indiana as straightforward as possible.

What Are Construction Draws?

Construction draws (also called loan draws) are the scheduled, partial payments your lender releases from your construction loan as your home is built. Instead of giving the full loan amount to the builder upfront—as happens with a traditional mortgage—your lender sends money out in phases, each tied to a specific stage of construction.

These stages are laid out in a draw schedule, which might include milestones like:

- Site preparation and utilities

- Foundation

- Framing and roofing

- Mechanical systems (electrical, plumbing, HVAC)

- Interior finishes and final inspection

At each milestone, the builder requests a draw. Before the lender releases funds, progress is usually verified by an inspector or appraiser to confirm the work has been completed to plan and meets local building codes in Indiana. Once that’s confirmed, the lender pays the builder for that phase of work.

This draw system protects you in several ways:

- Your builder is paid only for work that’s actually been done and inspected.

- You only pay interest on the funds that have been drawn so far, not the entire loan amount from day one.

- There’s a clear paper trail showing what was completed at each stage and how much was paid.

In short, construction draws are the mechanism that connects construction progress, builder payments, and your loan—keeping the project accountable, more predictable, and easier to manage financially as your new home takes shape.

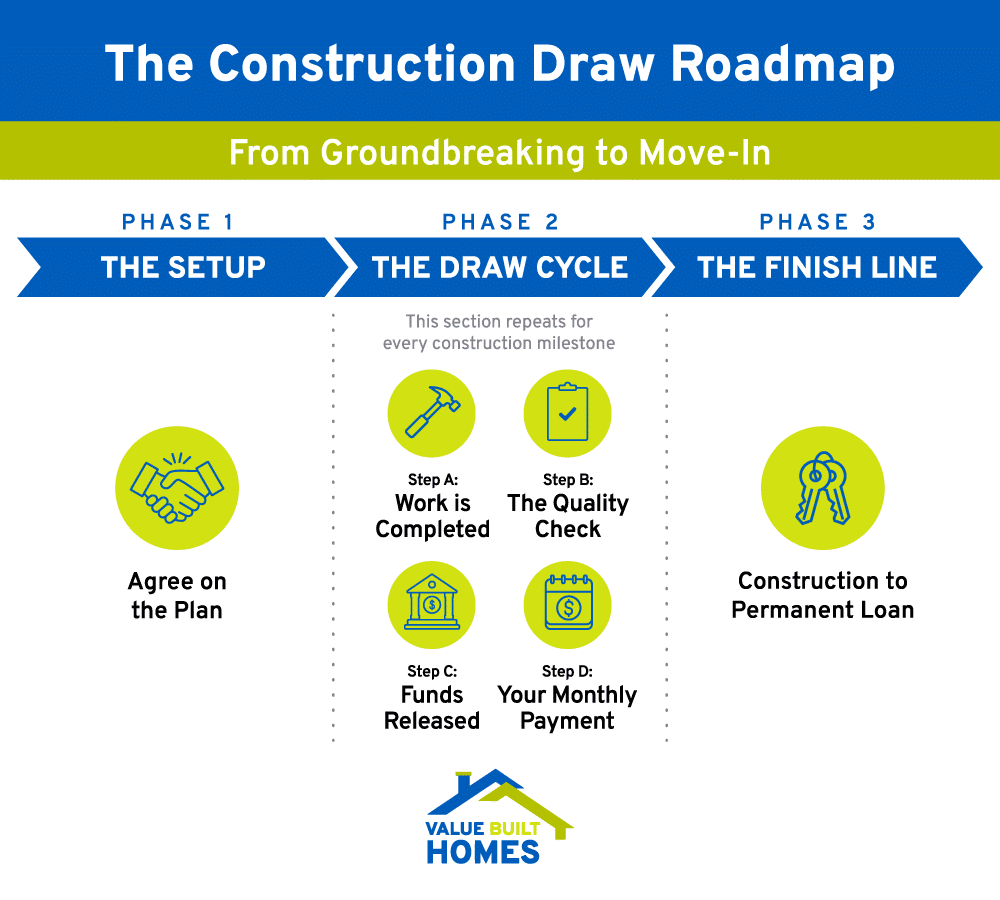

The Construction Draw Process Explained Step-by-Step

The structured nature of construction draws ensures that funds are managed responsibly. Here’s a breakdown of the process:

Step 1: Establishing the Draw Schedule

Before building begins, you, your lender, and your builder agree on a draw schedule outlining the specific milestones and the percentage of funds allocated to each stage. Common milestones include site preparation, foundation, framing, mechanical installations, and finishing work. Establishing a clear schedule upfront prevents miscommunication later and sets realistic expectations from the start.

Step 2: Submitting Progress Documentation

As work is completed, your builder submits supporting documentation—such as invoices, receipts, or photos—to request a draw. This documentation confirms that the agreed-upon tasks have been finished according to plan. Detailed records help protect both buyers and builders by ensuring that every dollar spent is tied to measurable improvements on site.

Step 3: Inspections to Verify Milestones

A licensed inspector or appraiser visits the site to verify that the completed work meets quality standards and local building codes. Only when these inspections confirm that the work is up to standard will the lender move forward with approving the draw. This step is crucial because it serves as a safeguard against subpar work or deviations from the construction plan, thereby ensuring high-quality results.

Step 4: Lender Approval and Fund Release

After reviewing the documentation and inspection reports, the lender approves the draw and releases the funds to the builder. If any issues or discrepancies are found, payment may be delayed until corrections are made. This careful control ensures that funds flow only when genuine construction milestones are met.

Step 5: Final Milestone and Transition to Mortgage

Once the final phase of construction is completed and thoroughly inspected, the last draw is released. At this point, the construction loan typically converts into a permanent mortgage, either seamlessly or through a refinancing process. This transition marks the culmination of the construction phase and the start of regular mortgage payments.

When Does My Builder Get Paid? (And What Does That Mean for Me?)

A common concern among homebuyers is understanding when the builder is paid. Payments are directly tied to milestone-based disbursements. For example, after the foundation is completed and verified, the builder submits a draw request, and funds are released accordingly. This system ensures that payment is made for work that is complete and verified, aiding in clear financial accountability and minimizing the risk of paying for incomplete work.

In addition to milestone-based payments, this structured schedule also helps prevent incomplete work. Homebuyers gain reassurance when funds are not released as a lump sum, which minimizes risks such as poor workmanship or cost overruns. The organized payment schedule instills confidence in both the lender and the buyer regarding the progress of the construction project.

How Your Payments Work: From Construction to Permanent Mortgage

Understanding how your payments change over time is key to budgeting confidently for a new build. With a construction loan, your costs come in two main phases: while the home is being built, and after construction is complete.

During Construction: Interest-Only

While your home is under construction, you typically make interest-only payments on the money that has actually been drawn from your construction loan—not the full approved amount.

Here’s how it works:

- Payments start after the first draw: Once your lender releases the first draw (for example, for foundation work), you begin paying interest on that portion of the loan.

- Payments increase as more draws are taken: Each time a new draw is released for another phase—such as framing, mechanicals, or finishes—the total amount you’ve borrowed increases. As a result, your interest-only payment will go up.

- You’re not paying principal yet: During this phase, you generally pay only interest, which helps keep your monthly payments lower while you may still be paying rent or a current mortgage.

- Monitoring is important: Keeping an eye on the draw schedule, construction progress, and your monthly statements helps you anticipate how your interest payments will change and plan ahead for your budget in Indiana’s variable construction timelines.

After Construction: Permanent Mortgage

Once construction is complete and final inspections are passed, your construction loan typically converts into a permanent mortgage (sometimes called a construction-to-permanent or “one-time close” loan). In some cases, this involves a separate refinance or second closing—your lender will outline which applies to you.

At this stage:

- Final inspections and documentation are completed: The lender verifies that the home meets building codes, quality standards, and the agreed plans. Any variances from the original budget may be reviewed before conversion.

- You begin paying principal + interest: Your payments shift from interest-only to a standard mortgage payment that includes both principal and interest, spread over the agreed term (for example, 15, 20, or 30 years).

- Your long-term budget becomes clear: Once the permanent mortgage is in place, your monthly payment stabilizes (unless you have an adjustable-rate loan). This is the number you’ll plan around for the long term.

- Any remaining details are finalized: Your lender, builder, and title company (if involved) make sure liens are released, final invoices are paid, and all closing documents are in order so you take full, clear ownership of your new home.

By understanding how payments work during construction and after conversion to a permanent mortgage, you can better plan your cash flow, avoid surprises, and move through the building process with confidence.

Why Construction Draws Help with Budgeting, Quality, and Transparency

Once you understand the basics of construction draws, the real value comes into focus: they’re designed to keep your money working only where real progress is happening. A milestone-based draw system offers several key advantages for homebuyers:

- Budget control: Because funds are released in stages, you can track spending against the construction timeline and address issues early—before they turn into major budget problems.

- Pay only for completed work: Each draw is tied to a specific phase that must be finished and verified. Your lender doesn’t release funds for work that hasn’t been done, which helps ensure you’re never paying ahead of actual progress.

- Better quality and inspections: Draws are typically released only after inspections confirm the work meets building codes and agreed standards. This creates a built-in quality checkpoint at every major milestone.

- Less risk of overruns or fraud: Because every payment is tied to a defined milestone and verified work, there’s less room for inflated invoices, incomplete work, or surprise overruns that go unnoticed until the end.

- Clear documentation trail: Each draw comes with documentation—such as invoices, inspection reports, and updated progress notes—creating a transparent record of what was done, when it was done, and what it cost. This makes it easier to resolve questions and keep everyone accountable throughout your build.

Delays and Your Draw Schedule: What Happens If Things Slip?

Even with solid planning, construction delays happen. Knowing how they affect your draw schedule and payments helps you stay prepared.

Realistic Causes of Delay

Common reasons timelines shift include:

- Weather – Rain, snow, or extreme cold slowing foundation, framing, or exterior work.

- Material shortages/shipping – Back-ordered windows, doors, or fixtures.

- Inspection or code issues – Items that must be corrected after an inspection.

- Change orders – Design or product changes you request mid-project.

Impact on Draws and the Interest-Only Phase

Because draws are tied to milestones, delays directly affect financing:

- Draws are pushed back: If a phase isn’t complete, the builder can’t request that draw and the lender won’t release it until work is finished and inspected.

- Interest-only may last longer: A longer build usually means more months of interest-only payments before the loan converts to a permanent mortgage.

- Budget planning matters more: Extra months of interest (and possibly rent or another mortgage) make it important to track progress and adjust your budget early if timelines shift.

How Value Built Homes Handles Communication and Schedule Changes

At Value Built Homes, the goal is to keep you informed—not surprised—if timing changes.

We focus on:

- Clear updates when timelines move – Explaining what caused the delay, how it affects specific milestones, and the revised expectations.

- Coordination with your lender – Aligning draw requests and inspections with actual progress so everyone shares the same timeline.

- Setting realistic expectations upfront – Discussing typical timelines and where delays are most likely, so you understand how they could affect your draw schedule and interest-only period.

With open communication between you, Value Built Homes, and your lender, delays become manageable adjustments—not major disruptions—to your build and budget.

Tips for First-Time Homebuyers Navigating Construction Financing

Understanding construction draws is the first step. The next is managing the process with confidence from pre-approval to move-in. These tips are especially helpful if you’re building your first home in Indiana.

Stay in regular contact with your builder and lender

Schedule check-ins or updates at key milestones. Consistent communication helps you understand what’s been completed, what’s coming next, and when draw requests and inspections will occur.

Review and understand the draw schedule up front

Before construction starts, go through the draw schedule line by line with your lender and builder. Clarify:

- What work is tied to each draw

- What documentation is required

- Who orders inspections and how long they take

This prevents surprises or delays when it’s time to release funds.

Document everything

Keep a simple folder (digital or physical) with:

- Contracts and change orders

- Invoices and lender statements

- Inspection reports and photos of work at each milestone

A clear paper trail makes it much easier to resolve questions or discrepancies later.

Build in a contingency budget

Weather, material delays, or minor changes can impact both schedule and cost. Setting aside a small percentage of your total budget as a contingency helps you absorb unexpected expenses without derailing the project.

Track your financing costs as you go

Monitor how much of your construction loan has been drawn and how your interest-only payments are changing as each draw is released. If something seems off, ask your lender to walk through the numbers with you.

Ask questions early and often

Don’t wait until you’re confused or stressed. If you’re unsure about a term in your loan, a line item in a draw request, or an inspection result, ask for clarification right away—from your builder, lender, or a trusted advisor.

Use trusted Indiana resources

For additional local insight, explore programs and information from organizations like the Indiana Housing and Community Development Authority (IHCDA), and consider speaking with a financial advisor. They can help you understand how a construction loan fits into your long-term budget and homeownership goals.

By staying informed, organized, and engaged throughout the process, you’ll make the most of the construction draw system and move through your home build with greater confidence and fewer surprises.

Frequently Asked Questions About Construction Draws

Do I pay the builder directly during construction?

In most cases, no. Your lender pays the builder through construction draws after work is completed and verified. You make interest-only payments to your lender on the funds that have been drawn so far.

How many construction draws are typical?

It varies by lender and project, but many new home builds use 4–8 draws tied to major milestones like foundation, framing, mechanicals, and finishes. The exact draw schedule is agreed on before construction begins.

Can a builder request a draw before the work is done?

They can request it, but lenders generally won’t release funds until the work tied to that draw is completed and passes inspection. This is one of the main protections built into the draw system.

What happens if an inspection fails or issues are found?

If an inspection finds problems, the builder must correct the issues before the lender will approve and release the draw for that phase. This helps ensure quality and code compliance at each step.

What if my project goes over budget?

If costs exceed the original budget, options may include adjusting finishes, adding more of your own cash, or—if allowed—reworking your loan with the lender. The sooner potential overruns are identified, the more flexibility you’ll have.

How does Value Built Homes help with the financing process?

Value Built Homes works with you and your lender to set a clear draw schedule, align milestones, and communicate progress throughout the build. The goal is to make the financing side as straightforward as possible while your new Indiana home is being constructed.

Mastering Construction Draws and Home Financing

Construction draws are more than just a payment schedule—they’re a system that keeps your build accountable, transparent, and aligned with your budget. By tying payments to defined milestones, requiring inspections before funds are released, and charging interest only on the money actually in use, construction draws help protect both your investment and your peace of mind. When you understand how draws work, when your builder gets paid, and how your own payments shift from interest-only to a permanent mortgage, the entire process becomes easier to plan and less stressful.

If you’re ready to build an affordable, site-built home in Indiana and want a builder who explains the financial side as clearly as the construction itself, Value Built Homes is here to help. Contact Value Built Homes today to talk through how a construction loan and draw schedule would work for you, get answers to your financing and timeline questions, and take the next step toward a new home built with clarity, quality, and confidence.